Monestro review 2023

Is Monestro a great platform for P2P lending? Find out in our Monestro review below:

Monestro

Pros:

Cons:

Review summary:

Monestro is a great up-and-coming P2P lending platform for investing in consumer loans. On the platform, you can invest in loans with an interest rate of 7-15%. The loans are protected with a buyback obligation, which means that loans will be bought back by the lending company if the borrower can’t repay. A unique thing about Monestro is its voluntary reserve that adds an extra layer of protection to the platform.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Monestro review

Are you considering investing via Monestro? Then read on. We’ve written this Monestro.com review to help investors determine if Monestro is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this Monestro review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our Monestro review:

- What is Monestro?

- Key features

- Who can use Monestro?

- How safe is Monestro?

- Our experience with Monestro

- Monestro reviews on Trustpilot

- Best Monestro alternatives

- Conclusion of our Monestro review

What is Monestro?

Monestro is a Peer-to-Peer lending platform that enables investors from Europe to invest in consumer loans from different lending companies.

The loans are secured with a buyback obligation and voluntary reserve – two features that will be explained later in this review.

Monestro launched in 2016 in Tallinn, Estonia. Since then a decent amount of investors have joined the platform to earn an average return of 7-15%.

With as little as €10, you can open an account and start investing at https://monestro.com/.

Monestro statistics:

| Founded: | 2016 |

| Loan Type: | Consumer |

| Loan Period: | 3 – 60 Months |

| Loans Funded: | € 500.000 + |

| Monestro Users: | 2.000 + |

| Minimum Investment: | € 10 |

| Maximum Investment: | Unlimited |

| Monestro Interest Rate: | 12.00% |

How Monestro works

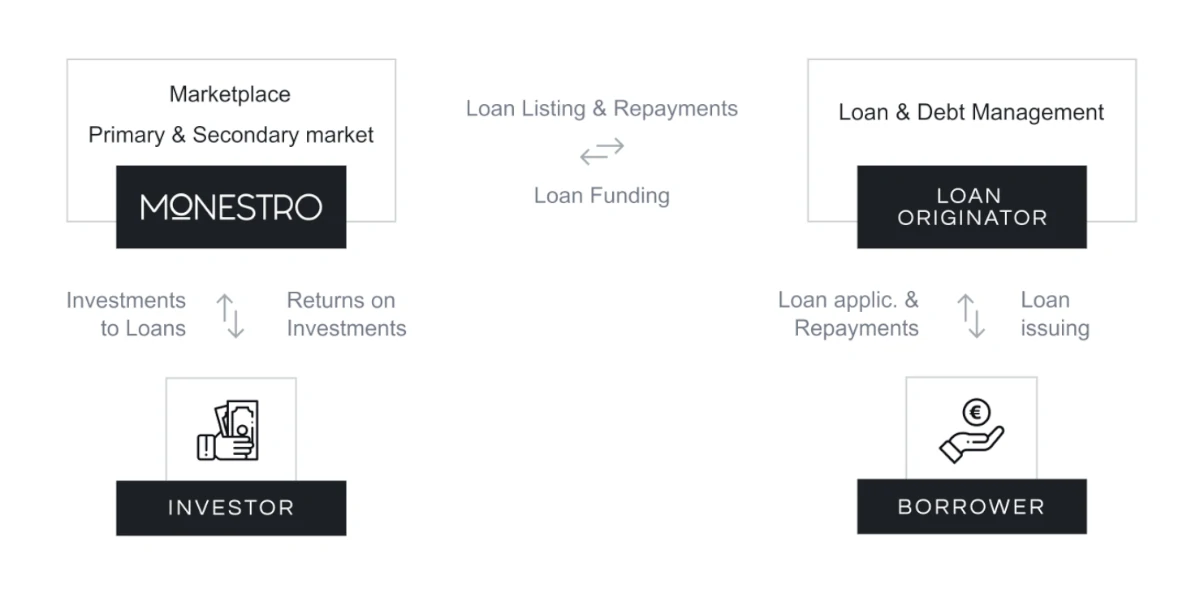

The Monestro platform works by being the middleman between loan originators and investors seeking to invest in loans.

On the platform, the carefully selected lending companies make some of their loan portfolio available for investment. Investors like you can then invest in the loans and earn a return.

This makes it possible for lending companies to gain more liquidity to issue more loans and grow their business.

In this way, a win-win situation is created between the loan originators and investors like you.

The loan originators on Monestro are NÚNÚ LÁN, Credit Consulting Services, Fresh Finance Group, and DSA Invest.

Frequently asked questions:

Key features

We have already taken a look at some of the reasons why Monestro has become a popular choice among investors. In the following, we take a closer look at some of the key features that make it easy to invest via the platform:

1. Monestro buyback obligation

All loans on Monestro are covered by a buyback obligation.

This basically means that a loan originator will have to buy back the loan principal and any accrued interest if the borrower isn’t repaying the loan after being 60 days late on repayment.

Here you should be aware that a buyback guarantee is only as safe as the one behind it. In this case the loan originators.

So if the loan originator defaults, the buyback obligation could end up being useless. More on this in the next feature.

2. Monestro voluntary reserve

Since there is the risk of loan originators going bankrupt and not being able to fulfill their buyback obligation, Monestro has implemented a voluntary reserve to protect investors further.

The Monestro voluntary reserve is funded each month with 0,35-0,55% of the outstanding principals of all claims. The exact amount is determined by Monestro depending on a risk assessment of the claims.

Should a loan originator not be able to comply with the buyback obligation, the voluntary reserve is used to buy loans from the investors.

3. Monestro auto-invest

If you want to avoid manually selecting loans, you can use the Monestro auto-invest feature to set your investments on autopilot.

To use the Monestro auto-invest feature, do the following:

- Sign up at https://monestro.com/

- Log in to your account

- Click “Autoinvest” in the sidebar

- Create an auto-invest strategy

The auto-invest feature was released in February 2022.

Who can use Monestro?

Both individuals and companies can invest via Monestro.

Individuals

Individuals seeking to invest via Monestro must at a minimum meet the following requirements:

- Being at least 18 years old

- Have a bank account in the European Economic Area

- Have their identity verified by Monestro

If you live up to these requirements, then you can probably start investing via the platform.

Companies

If you own a company, you can also use it to invest via Monestro.

In addition to what individuals must provide upon signing up, companies will also have to supply the following to Monestro to meet AML requirements:

- Registration documents

- Information about ultimate beneficial owners

- Identification of a company representative

Available countries

Monestro is available in the European Economic Area (European Union, Iceland, Liechtenstein, and Norway) and Switzerland.

Currently, investors from the UK can’t invest via Monestro.

If you are looking for similar platforms that are more widely available, you should take a look at either Bondster or Lendermarket.

How safe is Monestro?

To determine if Monestro is safe, we have taken a look at some of the potential upsides and downsides of investing with Monestro.

1. Monestro profitability

Unfortunately, the company behind the platform, Monestro P2P OÜ, doesn’t have any publicly available financial reports to verify the profitability of the company.

2. Main risks

In the following, we go through some of the main risks of using Monestro that we have considered:

Loan default risk

When you invest in P2P loans, there is a risk that the borrower will not be able to repay his loan. In that case, your investment is usually lost.

However, all loans at Monestro have a buyback obligation that can secure you against this type of event.

The buyback obligation is provided by the loan originators on the platform.

The best way to hedge against loan default risk is to invest in many different loans. In addition, it may be a good idea to choose loans with a buyback obligation.

Loan originators risk

The loan originators also pose a risk to investors. If they are not in control of their finances, have poor management, or the like, then they run the risk of going bankrupt like any other business. This can mean that they end up being unable to exercise their buyback obligation.

In order to protect you against the loan originator risk, Monestro has created a voluntary reserve. Funds in this reserve is used to buy back loans from investors if the lending companies themselves become unable to do so.

Monestro bankruptcy risk

As with any business, there is a risk of Monestro going bust. If this happens, investors will be given full information about transactions from the Monestro database. An appointed liquidator or administrator can also transfer the servicing of all investments to an appropriate manager.

Financial turndown risk

As P2P investing is a newer thing in the investment world, it can be difficult to predict how a financial turndown would affect this form of investment. As a starting point, it is, therefore, a really bad idea to invest your entire investment portfolio in P2P investments.

Therefore, many investors also choose to diversify into more traditional forms of investment such as equities, bonds, and traditional real estate.

Since investing is an individual thing, we obviously do not know what will be best for you. But if you put together your investment portfolio, make sure that it reflects your knowledge of the investments in it, as well as your own risk appetite. If in doubt about how to do so, make sure to seek help from a professional investment planner.

Is Monestro safe?

Monestro seems to have done a lot to make investors as safe as possible. They do this with both a buyback obligation on loans and a voluntary reserve in case the buyback obligation fails.

But we would have liked Monestro to be a bit more transparent with its operations by providing an annual report for investors to learn about the stability of the business model.

Furthermore, other factors such as lack of knowledge about how a financial turndown will affect the P2P lending industry are also risk factors that are worth considering.

Our experience with Monestro

In our experience, Monestro seems like a great up-and-coming P2P lending platform.

Compared to other P2P lending platforms, the way the platform differentiates itself the most is by having a voluntary reserve as extra protection against default of loans and loan originators.

Apart from this, the platform lags in features and transparency compared to other more evolved P2P lending platforms.

Monestro reviews on Trustpilot

Trustpilot is a great place to learn what other people think of Monestro. We have collected some relevant Monestro reviews from Trustpilot for you to take a closer look at:

There are currently no relevant Trustpilot reviews of Monestro.

Best Monestro alternatives

Not sure Monestro is the right choice for you? Then there are also some good Monestro alternatives to consider. The following are some of our favorites:

- PeerBerry (consumer lending platform)

- ReInvest24 (real estate crowdfunding platform)

- AxiaFunder (litigation crowdfunding platform)

- Debitum (P2B lending platform)

Even if you use Monestro, it might actually be a good idea to take a closer look at some of the above platforms. By using multiple platforms, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our Monestro review

Monestro is a great up-and-coming P2P lending platform for consumer lending. The platform is user-friendly but lags some of the more advanced features of bigger P2P lending platforms.

Monestro is protecting investors with both a buyback obligation on loans and a voluntary reserve that works as an extra layer of protection.

At the same time, the loan originators keep a high amount of skin in the game compared to a lot of other platforms. This is a good indication, as it signals a higher amount of alignment between the loan originators and investors.

Overall, Monestro is a great choice for a P2P lending platform for investors wanting to dip their toes into P2P investing.