Heavy Finance review 2023

Is Heavy Finance a great platform for P2B lending? Find out in our Heavy Finance review below:

Heavy Finance

Pros:

Cons:

Review summary:

HeavyFinance is one of the best P2B lending platforms, focusing on secure agricultural loans. On the platform, you can invest in asset-backed loans that yield an average annual return of over 10%. The platform was founded by an experienced team that has successfully built other P2P lending platforms. There has been a 0% loss of investors’ funds on HeavyFinance. You can invest passively with auto-invest and exit your investments early with the secondary market. The only downside of the platform is that many loans are delayed, and the average Loan-to-Value (LTV) ratio is high. Otherwise, investors can trust HeavyFinance as a reliable and secure investment platform.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our HeavyFinance review

Are you considering investing via HeavyFinance? Then read on. We’ve written this HeavyFinance.com review to help investors determine if HeavyFinance is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this HeavyFinance review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our HeavyFinance review:

- What is HeavyFinance?

- Key features

- Who can use HeavyFinance?

- How safe is HeavyFinance?

- Our experience with HeavyFinance

- HeavyFinance reviews on Trustpilot

- Best HeavyFinance alternatives

- Conclusion of our HeavyFinance review

What is HeavyFinance?

HeavyFinance is one of the best agriculture crowdfunding platforms in Europe. The platform is primarily focused on financing farming, forestry, and infrastructure.

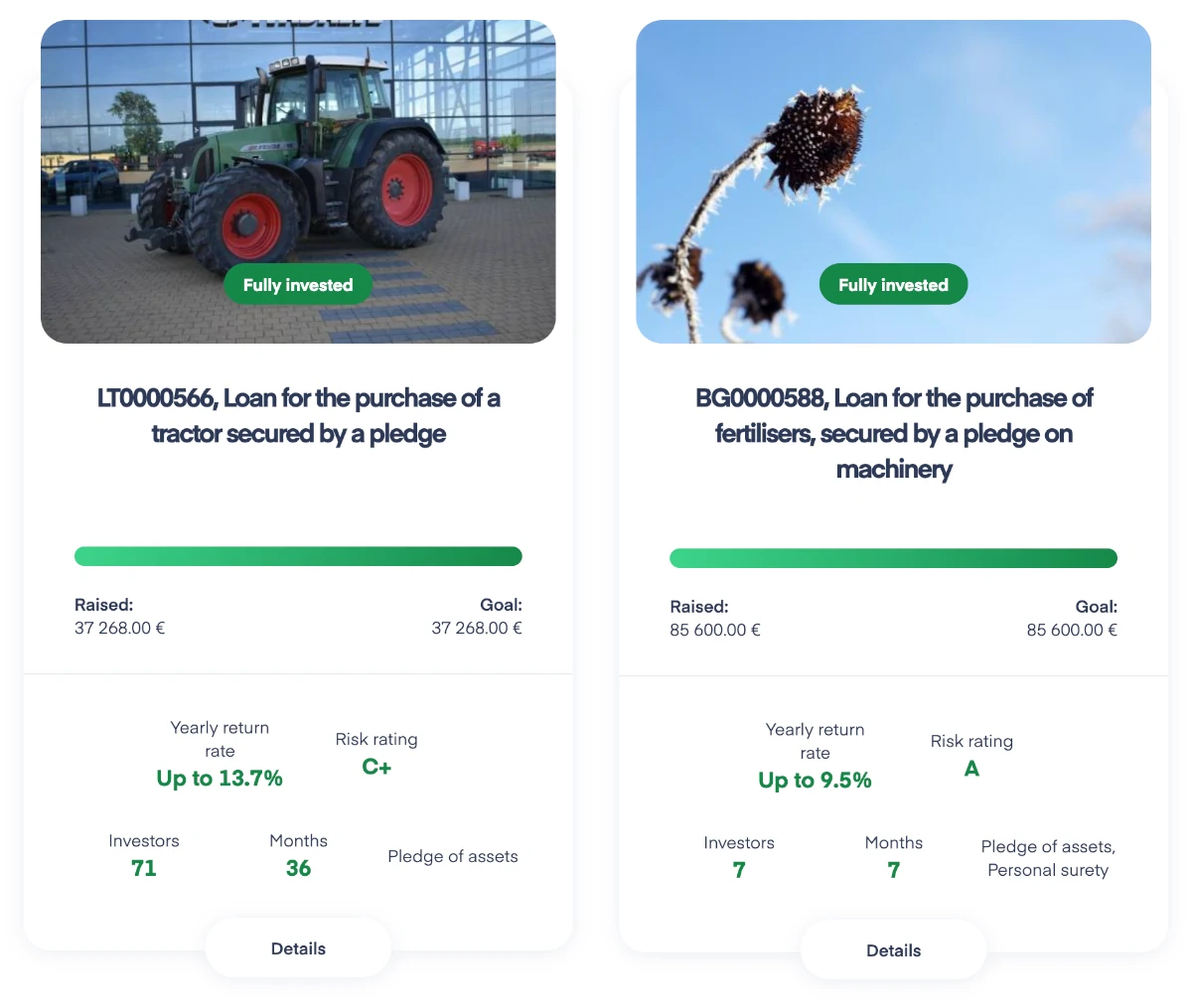

The loans on the platform are backed by heavy machinery as collateral. They have an average LTV (Loan-To-Value) of 63.71%.

HeavyFinance was co-founded in 2020 by Laimonas Noreika, Andrius Liukaitis, and Darius Verseckas. The team is highly experienced with years of skills in the fintech and P2P industry.

Since the platform was launched, it has quickly become popular among P2P investors. Over 9,911 investors have trusted HeavyFinance with millions of Euros in combined deposits. And the average investor’s portfolio size is a staggering €8,673.

HeavyFinance is regulated by the Bank of Lithuania and offers an attractive average annual return of 13.23%.

With as little as €100, you can open an account and start investing at https://heavyfinance.com/.

HeavyFinance statistics:

| Founded: | 2020 |

| Loan Type: | Agricultural |

| Loan Period: | 4 – 48 Months |

| Loans Funded: | € 42,290,300 + |

| HeavyFinance Users: | 9,911 + |

| Minimum Investment: | € 100 |

| Maximum Investment: | Unlimited |

| HeavyFinance Interest Rate: | 13.23 % |

| Loss of Investors’ Money: | 0% |

How HeavyFinance works:

HeavyFinance has a two-sided business model. On the one hand, they have investors. And on the other hand, they have farmers that are seeking funds for machinery, fertilizer, and more.

The process works as follows:

- The farmer requests a loan at HeavyFinance

- The company analyzes the financial data of the farm and assigns a credit risk ranking

- After signing an agreement with the farmer, the loan is made available for investment on HeavyFinance

- Investors have up to 14 days to invest in a loan. A big part of projects gets fully funded the same day

- After the full amount is funded, HeavyFinance signs the first-hand mortgage and collects all the remaining documents to issue a loan

- The loan is issued and your money is earning profit

Frequently asked questions:

Key features

We have already taken a look at some of the reasons why HeavyFinance has become a popular choice among investors. In the following, we take a closer look at some of the key features that make it easy to invest via the platform:

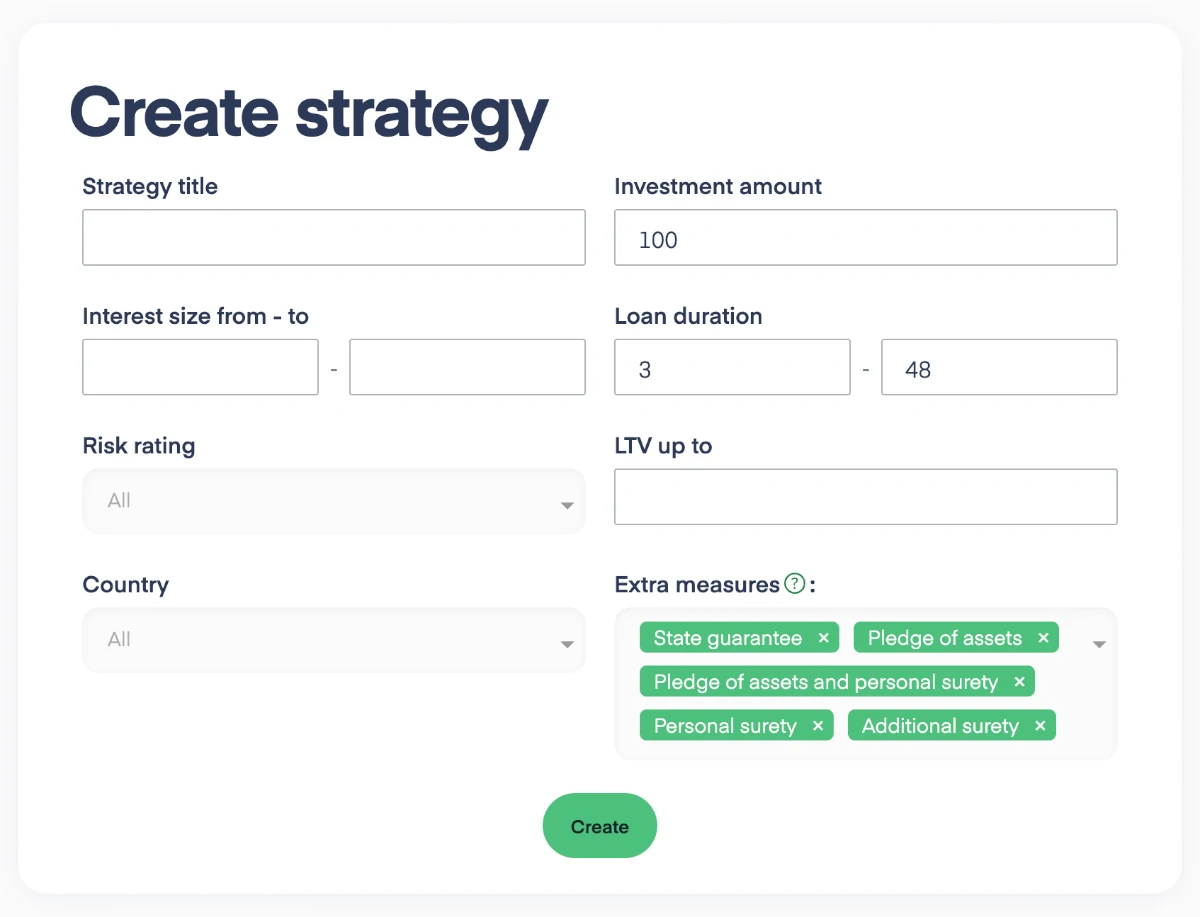

1. HeavyFinance auto-invest

On HeavyFinance you will find an auto-invest tool that helps you automate your investments in loans on the platform.

To use a HeavyFinance auto-invest tool, simply do the following:

- Make sure you have signed up

- Log in to your investor account

- Create an auto-invest strategy

The auto-invest tool allows you to define the investment amount, interest rate, loan duration, risk class, loan type, loan-to-value (LTV), and country.

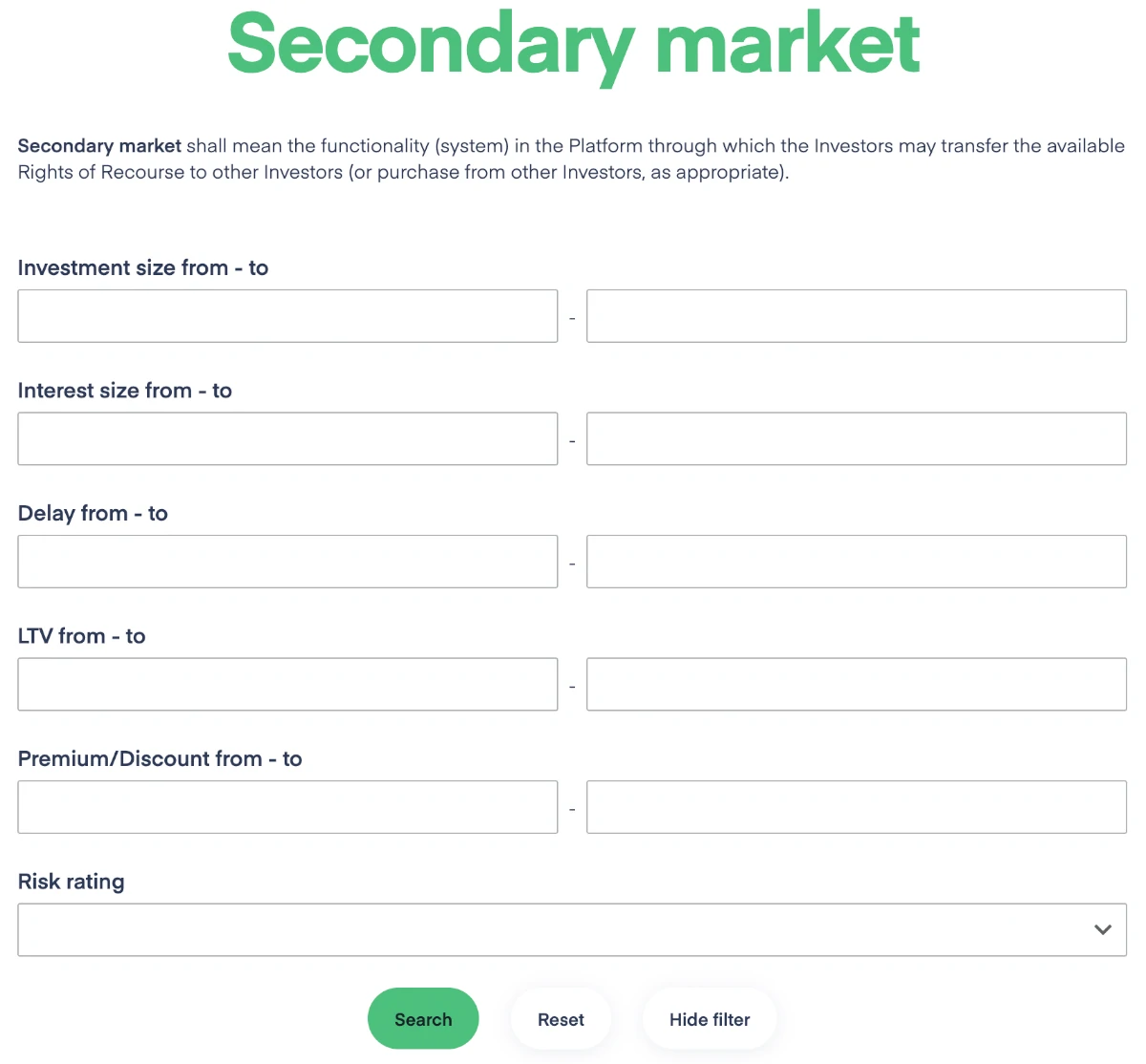

2. HeavyFinance secondary market

HeavyFinance offers a secondary market that allows you to sell your investments before they are fully paid back.

This tool is very useful if you decide to leave the platform or if you just want to free up some capital.

You should keep in mind that there is a 1% selling fee when you sell loans on the HeavyFinance secondary market.

3. Get a 2% HeavyFinance bonus without a promo code

HeavyFinance offers a 2% investment bonus for new investors who get referred to the platform via an affiliate link. The bonus is active for 30 days.

Click the button below to get your +2% HeavyFinance bonus (no referral or promo code needed):

Who can use HeavyFinance?

Both individuals and companies can invest via HeavyFinance.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Being at least 18 years old

- Having your identity verified

If you live up to these requirements, then you can start investing via the platform.

Companies

It is also possible to invest via HeavyFinance if you have a company. The same rules apply to companies as to individuals.

Available countries

HeavyFinance is available for investors from most countries across the world. The platform focuses on borrowers operating in the European Union with a primary focus on Poland, Lithuania, Latvia, Portugal, and Bulgaria.

How safe is HeavyFinance?

To determine if HeavyFinance is safe, we have taken a look at some of the potential upsides and downsides of investing with HeavyFinance.

But when you consider the safety of HeavyFinance, you shouldn’t only rely on the information found in this HeavyFinance review. It is always recommended that you do your own research before investing any money.

1. HeavyFinance profitability

UAB HEAVY FINANCE, the company behind HeavyFinance, made a net loss of €174,665 as stated in the annual report for the year 2020. In 2021 the company made a net loss of €617,141 and in 2022 it made a net loss of €1,106,571.

However, having a loss in the first years of operating is quite normal for new P2P lending platforms, as it requires a lot of capital to attract new investors and grow the business.

2. Main risks

In the following part of our HeavyFinance review, we go through some of the main risks of using HeavyFinance:

Loan default risk

When you invest in P2B loans, there is a risk that the borrower will not be able to repay the loan. In that case, your investment can be lost.

The best way to hedge against loan default risk is to invest smaller amounts in many different loans, rather than investing large amounts in only a few loans. Looking for loans with a low LTV is also a good idea.

In addition to this, HeavyFinance has implemented 3 primary ways of protecting your investments from losing all of your investment in case of loan default:

Sole accountability

Some of the smaller loans on HeavyFinance are only secured by the project owner’s sole accountability. This means that the farmer is liable for the loan with personal properties if the loan defaults.

Sole accountability is only for loans of up to €15,000.

Pledge of assets

A lot of the loans on HeavyFinance are secured with a pledge of assets. Here the borrower uses land, heavy machinery, or an agreement of purchase and sale as collateral for the loan.

Individual state guarantee

Some loans on HeavyFinance are secured with an extra measure of security provided by the Agricultural Credit Guarantee Fund of Lithuania. Loans secured by this fund are guaranteed with up to 80% of the outstanding credits.

You can learn more about the credit guarantee provided by the Agricultural Credit Guarantee Fund here.

HeavyFinance bankruptcy risk

Of course, there is also a risk of HeavyFinance going bankrupt. Like many other European P2B lending platforms, HeavyFinance has also taken precautions in the contracts, should this happen.

Financial turndown risk

As P2P investing is a newer thing in the investment world, it can be difficult to predict how a financial turndown would affect this form of investment. As a starting point, it is, therefore, a really bad idea to invest your entire investment portfolio in P2P investments.

With that said, there was no large decline in prices of heavy machinery in the financial crisis of 2008, as people always need food despite the economic situation. During Covid-19, the agricultural sector was also one of the least negatively affected sectors in the world.

Even so, it’s always a good idea to diversify into more traditional forms of investment such as equities, bonds, and traditional real estate.

Since investing is an individual thing, we obviously do not know what will be best for you. But if you put together your investment portfolio, make sure that it reflects your knowledge of the investments in it, as well as your own risk appetite. If in doubt about how to do so, make sure to seek help from a professional investment planner.

Is HeavyFinance safe?

So far, HeavyFinance has proved to be a safer alternative to many other P2P lending platforms.

The principal in default is currently around 9%, but the recovery rate is fairly high on the platform. This is probably due to a combination of a highly experienced team and the fact that agriculture historically has been a quite safe place to invest money.

However, loans that already went through the full recovery process, were fully repaid with principal amount, interest, and delayed payment fees to investors.

Other factors such as a lack of knowledge about how a financial turndown will affect the P2P lending industry are also risk factors that are worth considering before you invest on the platform.

Our experience with HeavyFinance

Our overall experience with HeavyFinance is very positive. When you compare the platform to others on metrics like team experience, usability, and support, then they are among the better ones. At the same time, we believe that there is a fair balance between risk and reward on the platform.

There is nothing at the moment that is concerning about the platform.

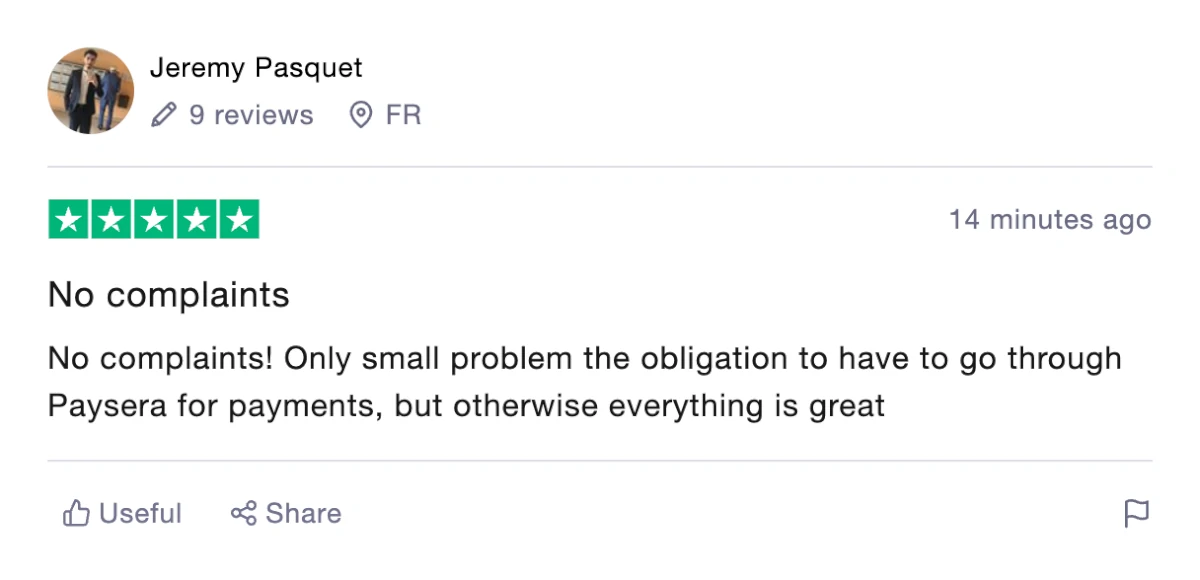

HeavyFinance reviews on Trustpilot

Trustpilot is a great place to learn what other people think of HeavyFinance. We have collected some relevant HeavyFinance reviews from Trustpilot for you to take a closer look at:

Best HeavyFinance alternatives

Not sure HeavyFinance is the right choice for you after reading our HeavyFinance review? Then there are also some good HeavyFinance alternatives to consider. The following are some of our favorites:

- LANDE (direct HeavyFinance competitor)

- PeerBerry (consumer lending platform)

- ReInvest24 (real estate crowdfunding platform)

- AxiaFunder (litigation crowdfunding platform)

- Debitum (P2B lending platform)

Even if you use HeavyFinance, it might actually be a good idea to take a closer look at some of the above platforms. By using multiple P2P lending platforms, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our HeavyFinance review

HeavyFinance is one of the absolute best P2P platforms for agricultural loans.

All the loans are secured with assets and the platform is regulated by the Bank of Lithuania.

The team behind the platform seems solid, which gives a great future outlook for the platform.

To this date, there has been a 0% loss of investor funds on the platform. This witness of a quite safe platform. But you should keep in mind that there have been many delayed loans on the platform.

The annual return on the platform is around 13.23%, which is fairly good compared to similar platforms.