Lendermarket review 2024

Is Lendermarket a great platform for P2P lending? Find out in our Lendermarket review below:

Lendermarket

Pros:

Cons:

Review summary:

Lendermarket is no longer one of the top P2P lending platforms in Europe due to issues with payments. The platform is a part of Creditstar Group which is a large profitable finance group. The return on the platform at around 15% is one of the best in the industry. Your investments are protected with a Buyback Guarantee. The four biggest drawbacks of the platform are that you will only find loans from five loan originators, a lot of pending payments, a lag of transparency of the loan performance, and no secondary market yet. Investors should exercise caution before using Lendermarket.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Lendermarket review

Are you considering investing via Lendermarket? Then read on. We’ve written this Lendermarket.com review to help investors determine if Lendermarket is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this Lendermarket review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our Lendermarket review:

- What is Lendermarket?

- Key features

- Who can use Lendermarket?

- How safe is Lendermarket?

- Our experience with Lendermarket

- Lendermarket reviews on Trustpilot

- Best Lendermarket alternatives

- Conclusion of our Lendermarket review

What is Lendermarket?

Lendermarket is a Peer-to-Peer lending platform that enables investors from around the world to invest in loans from CrediFiel, Creditstar Group, Dineo, QuickCheck, and RapiCredit.

The loans on the alternative lending market are covered by a buyback guarantee which will be explained later (in this section).

Lendermarket is based in Ireland and the platform was launched in 2019.

The company behind Lendermarket is the sister company of the Creditstar Group – which is where many of the loans on the platform originate from.

Previously, Creditstar had its loans available for investment on other P2P platforms like Mintos. But with the launch of Lendermarket it seems like the group is seeking more control over the funding process of the loans.

Since the launch of Lendermarket, the platform has experienced a high amount of growth as Creditstar historically has been one of the favorite lenders among P2P investors.

In May 2022, Lendermarket became a multi-lender as they added the option to invest in loans from Credory. Since then a lot more lending companies has been added to the platform.

Currently, the platform has over 17,000 users. The investors are earning an average return of around 15.64%.

With a minimum investment of €10, you can also open an account.

Lendermarket statistics:

| Founded: | 2019 |

| Loan Type: | Consumer |

| Loan Period: | 1 – 80 Months |

| Loans Funded: | € 395.000.000 + |

| Lendermarket Users: | 17.000 + |

| Minimum Investment: | € 10 |

| Maximum Investment: | Unlimited |

| Lendermarket Interest Rate: | 15.64% |

How Lendermarket works:

The overall journey of the investments on Lendermarket follows the following process (based on loans from Creditstar).

First, a borrower applies for a loan at Creditstar. If the loan is accepted, Creditstar will grant the loan to the borrower with the company’s own money.

Now Creditstar turns to Lendermarket to make the loan available for investment. From here, investors like you can invest in the loans and make a profit.

To make sure that the lending company is still making money, the loans are offered at a lower rate than what the company is making on it.

When the loan is fully funded, Creditstar now has more money to issue more loans.

In this way, a win-win situation is made between the lending company and the investors on Lendermarket.

Frequently asked questions:

Key features

We have already taken a look at some of the reasons why Lendermarket has become a popular choice among investors. In the following, we take a closer look at some of the key features that make it great to invest via the platform:

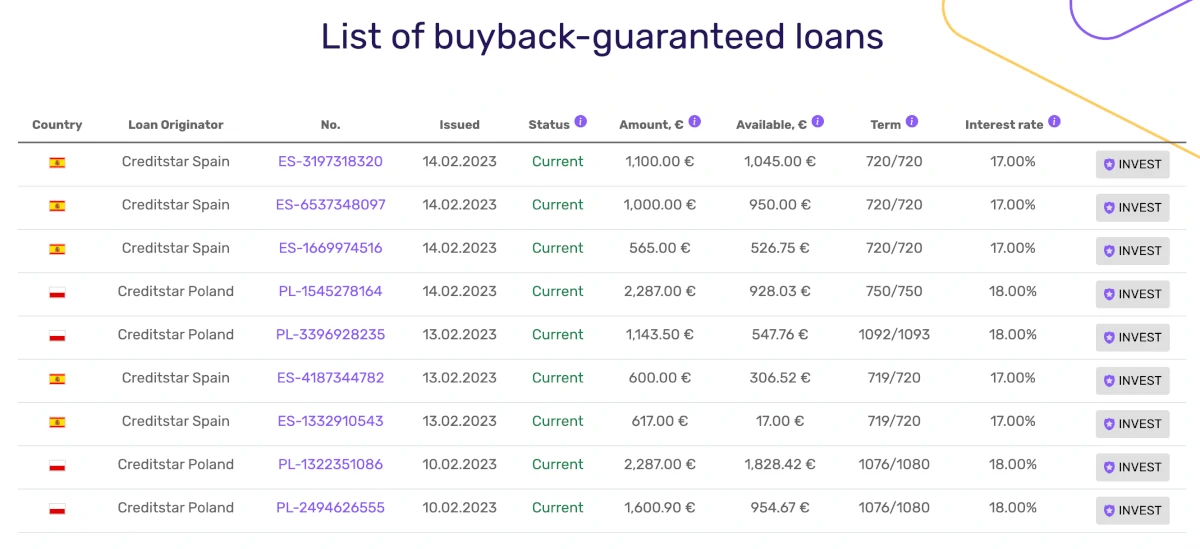

1. Lendermarket Buyback Guarantee

All loans at Lendermarket come with a Buyback Guarantee.

Essentially, the Lendermarket Buyback Guarantee is a guarantee from the lending company to buy back loans that are more than 60 days overdue.

Here, the investor will be paid both the invested amount of money in the loan as well as the accrued interest in the period.

The Buyback Guarantee is issued by the loan originator and not Lendermarket.

A thing that you have to keep in mind when you hear about buyback guarantees is the fact that the guarantee is only as solid as the one behind it.

If the lending company behind the loan starts struggling, the loan might not get bought back.

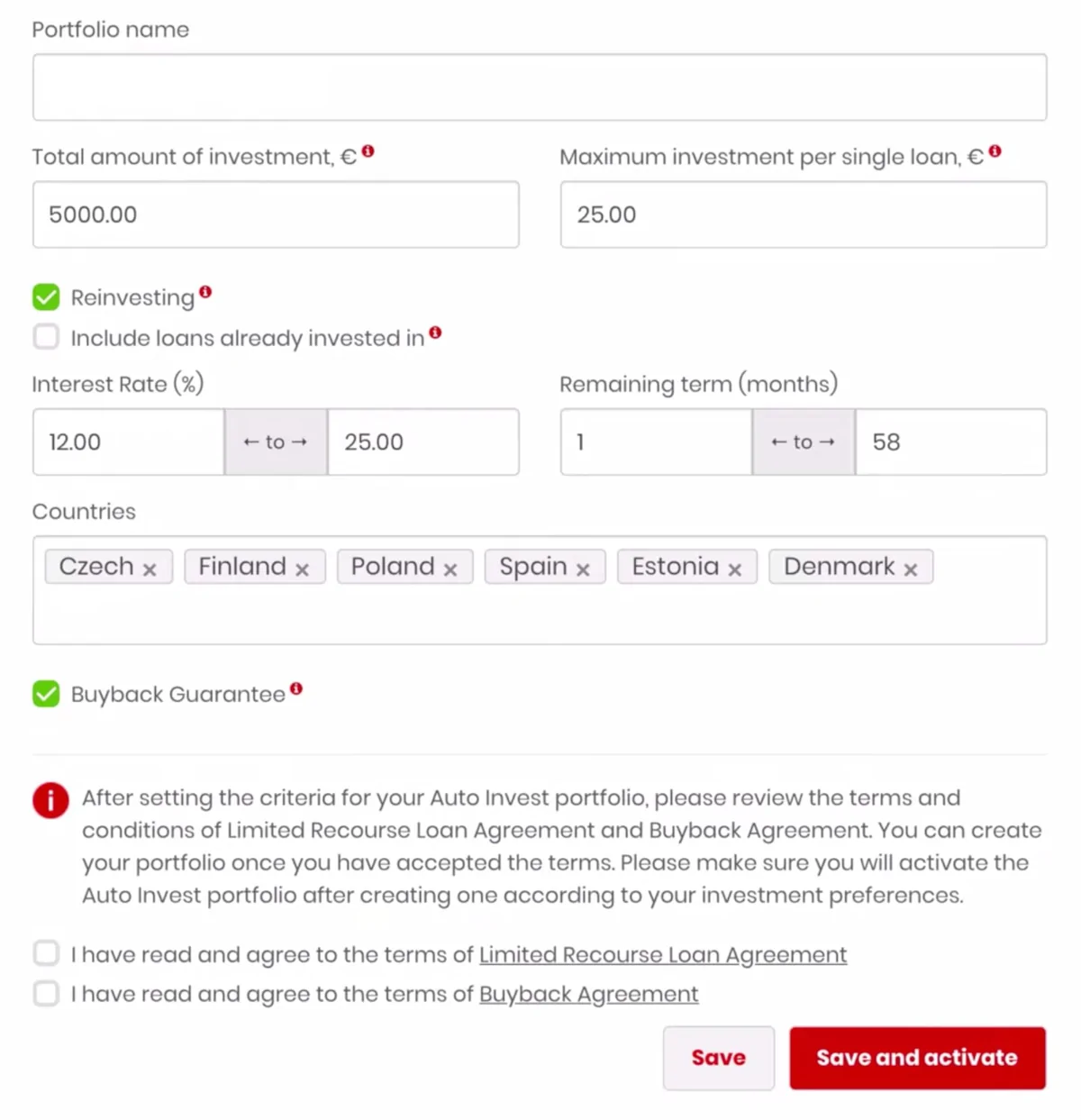

2. Lendermarket auto-invest

Like a lot of other platforms, Lendermarket offers an auto-invest feature that makes it possible for you to put your loan investments on autopilot.

To use their auto-invest tool, simply follow this process:

- Make sure you have signed up

- Log in to your account

- Go to “Auto Invest”

- Click “Create New”

From here, you can make an auto-invest portfolio that suits your investment goals. You can set up criteria for this feature to make it invest exactly as you want it to:

We recommend that you set the maximum per single loan low in order to be diversified between many loans.

Reinvesting is necessary if you want to invest automatically without having to check back all the time.

In order to make sure that you only get loans with the Buyback Guarantee, it is a good idea to select Buyback Guarantee only. This way you will only get loans with the guarantee – even if Lendermarket suddenly introduces loans without it.

If you want to know more about auto-investing, you can find more information on Lendermarket’s website here.

3. Lendermarket 1% cashback bonus

Lendermarket offers a 1% cashback bonus for new investors who gets referred to its platform.

We have received an affiliate link from Lendermarket, which means that you can get a 1% bonus for 60 days by using our referral link.

All you have to do to get the Lendermarket cashback is to activate the bonus by clicking the button below:

Who can use Lendermarket?

Both individuals and organizations can invest via Lendermarket.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Being at least 18 years old

- Being from one of the available countries (see below)

- Get your identity successfully verified by Lendermarket

If you can live up to these requirements, then you can start investing via the platform.

Organizations

If you run a company, you can also invest via Lendermarket. All you have to do in order to create an account for your business is to select “Company” when signing up.

If you are in doubt about registering as a company, you can just reach out to the support team. You can find the information here.

Available countries

Even though the loans are dealt with in EUR, it is possible to invest via the platform from around the world. The following is a list of all the countries that can invest via Lendermarket:

Albania, Andorra, Argentina, Armenia, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Brazil, Bulgaria, Canada, Chile, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Georgia, Germany, Gibraltar, Greece, Greenland, Hong Kong, Hungary, Iceland, India, Indonesia, Isle Of Man, Israel, Italy, Japan, Kazakhstan, Kosovo, Kyrgyzstan, Latvia, Liechtenstein, Lithuania, Luxembourg, Macao, Malaysia, Malta, Mexico, Moldova, Monaco, Montenegro, Netherlands, New Zealand, Norway, Panama, Philippines, Poland, Portugal, Qatar, Romania, Russia, San Marino, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, Turkmenistan, Ukraine, United Arab Emirates, United Kingdom, Uruguay, Uzbekistan.

How safe is Lendermarket?

To determine if Lendermarket is safe, we have taken a look at some of the potential upsides and downsides of investing via the platform.

1. Lendermarket profitability

As Lendermarket Limited is a very young company, founded in 2019, there is not much financial information available to determine the long-term profitability of the company yet.

According to the annual report for 2021, Lendermarket came out with a net loss of €1,017,209. This is quite normal for newer companies that are investing in growth.

Since Lendermarket is a part of Creditstar Group, which is a large lending group, this doesn’t seem too concerning.

2. Main risks

In the following, we go through some of the main risks of using Lendermarket that we have considered:

Loan default risk

When you invest in P2P loans, there is a risk that the borrower will not be able to repay his loan. In that case, your investment is usually lost.

At Lendermarket, you can invest in loans with a Buyback Guarantee to protect you against the loan default risk.

When you invest in loans with a Buyback Guarantee, the loan originator is required to buy back the loan if it becomes more than 60 days overdue.

A thing you must be aware of with the Buyback Guarantee is that it is dependent on the solvency of the loan originator. So if the loan originator goes bankrupt, the guarantee will be useless.

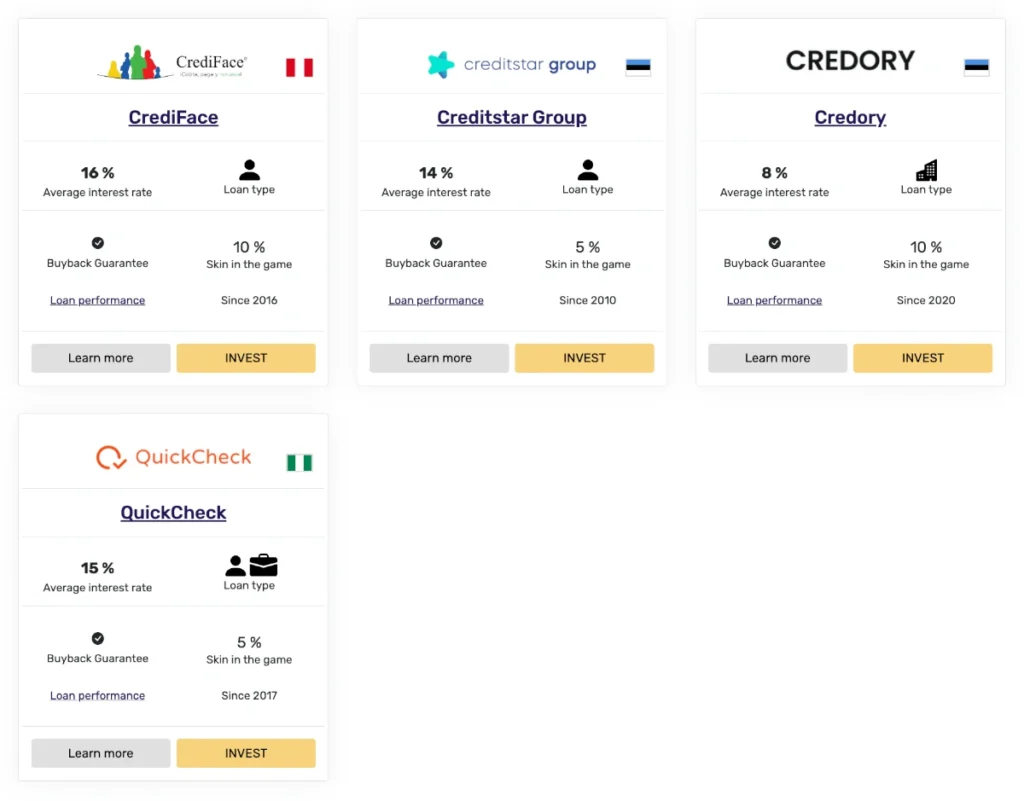

Loan originators risk

The loan originators also pose a risk to investors. If they are not in control of their finances, have poor management, or the like, then they run the risk of going bankrupt like any other business.

On Lendermarket, you will currently be able to find 5 loan originators:

- CrediFiel

- Creditstar Group

- Dineo

- QuickCheck

- RapiCredit

The financial situation of the Creditstar Group is great, and the company has been profitable for multiple years in a row.

According to its annual report, the company made a net profit of €7,376,000 in 2022.

Lendermarket is very transparent about the financials of Creditstar, and you are able to find much more information about the loan originator on the platform’s website.

Financial turndown risk

As P2P investing is a newer thing in the investment world, it can be difficult to predict how a financial turndown would affect this form of investment. As a starting point, it is, therefore, a really bad idea to invest your entire investment portfolio in P2P investments.

Therefore, many investors also diversify into more traditional forms of investment such as equities, bonds, and real estate.

Since investing is an individual thing, we obviously do not know what will be best for you. But if you put together your investment portfolio, make sure that it reflects your knowledge of the investments in it, as well as your own risk appetite. If in doubt about how to do so, make sure to seek help from a professional investment planner.

Is Lendermarket safe?

The safety of investing through Lendermarket is currently in question. While the platform may benefit from financial support from a large and profitable lending group that generated a net profit of €7,376,000 in 2022, many investors have reported issues with loan repayments and the loans being marked as “pending payment” for longer than usual periods of up to a year. When loans are in this status, the buyback guarantee is effectively rendered inactive.

Unfortunately, Lendermarket lacks transparency regarding loan performance, making it difficult to verify the extent of the issues with the repayments.

The platform has also experienced frequent changes in management, which could be viewed as a red flag, as stability in leadership is crucial for maintaining trust and continuity in operations.

Due to these reasons, investors should exercise caution and thoroughly research the platform before committing any funds.

Our experience with Lendermarket

Lendermarket has an easy-to-use platform and for the most part it offers an excellent investment experience. The auto-invest feature does its job but is not out of the ordinary.

Both depositing and withdrawing funds on Lendermarket are fairly easy. The processing only takes a few days. The only thing to be aware of is that they only accept transfers in euros and with SEPA transfers.

Unfortunately, the platform has had a longer track record of delayed loans, pending payments, and other loan repayment issues.

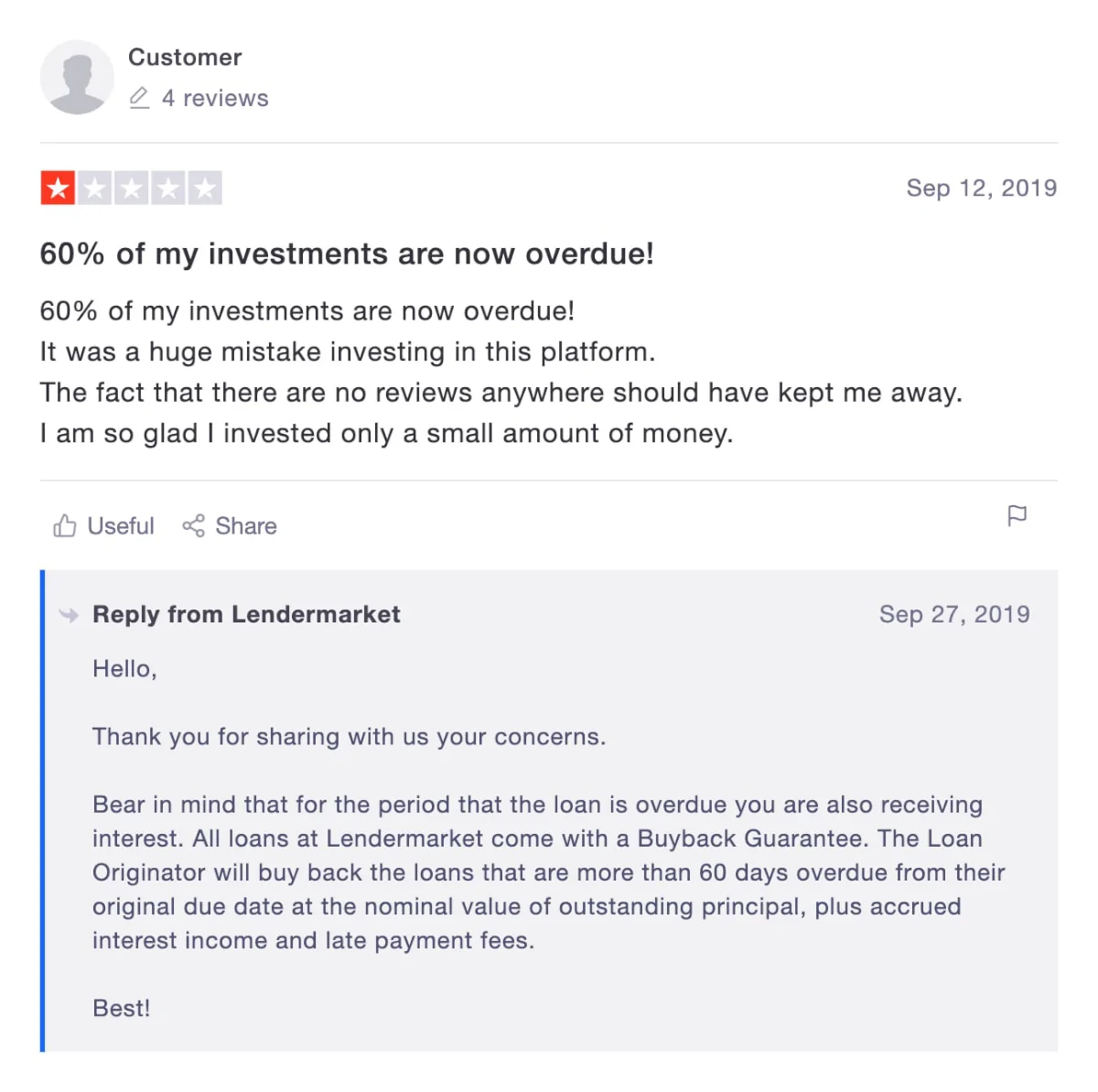

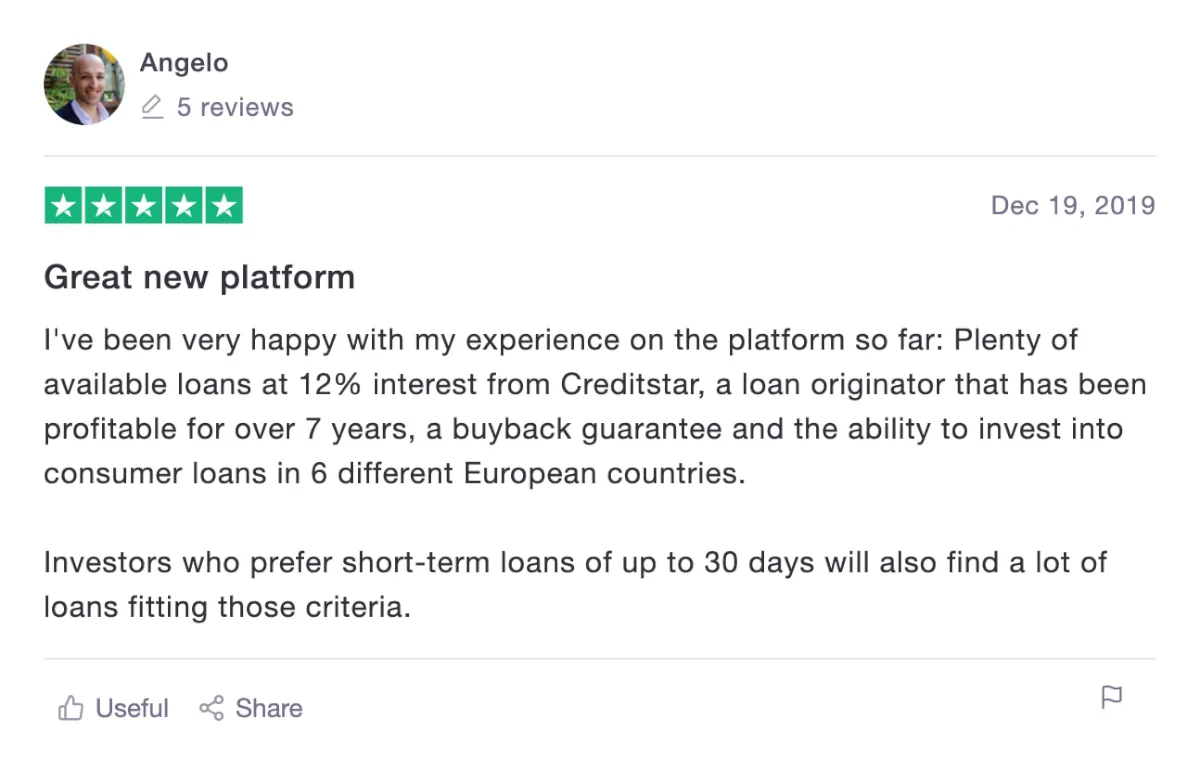

Lendermarket reviews on Trustpilot

Trustpilot is a great place to learn what other people think of Lendermarket. We have collected some bad and some good Lendermarket reviews from Trustpilot for you to take a closer look at:

Best Lendermarket alternatives

Not sure Lendermarket is the right choice for you? Then there are also some good Lendermarket alternatives to consider. The following are some of our favorites:

Even if you use Lendermarket, it might be a good idea to take a closer look at some of the above platforms. By using multiple platforms, you can reduce your platform risk and diversify your portfolio further.

Lendermarket vs Mintos

A lot of investors have asked about Lendermarket vs Mintos (one of the most popular P2P platforms). In the following, we review the similarities and differences:

On both platforms, you will be able to find Creditstar loans. But on Lendermarket you can invest in them with a slightly better return than on Mintos. This is due to the fact that Lendermarket is a part of Creditstar Group. With that said, Lendermarket doesn’t offer much else than loans from Creditstar.

In conclusion, Lendermarket is the best option if you want the best return on Creditstar bonds and loans, whereas Mintos is the best option for broader diversification into the P2P lending market.

Conclusion of our Lendermarket review

Lendermarket is a P2P lending marketplace featuring loans from CrediFiel, Creditstar Group, Dineo, QuickCheck, and RapiCredit. The platform includes essential features such as a Buyback Guarantee and an auto-invest feature, which has become more or less a standard feature.

Lendermarket advertises very high returns of around 15%, but these returns definitely come with some risks. While the platform benefits from the backing of a large and profitable lending group, reports of delayed loan repayments and a lack of transparency regarding loan performance raise concerns about the safety of investments. Additionally, frequent changes in management could indicate instability within the company.

Investors should exercise caution and conduct thorough research before committing funds to Lendermarket to mitigate the current payment risks.