Letsinvest review 2023

Is Letsinvest a great platform for real estate crowdfunding? Find out in our Letsinvest review below:

Letsinvest

Pros:

Cons:

Review summary:

Letsinvest is one of the best real estate crowdfunding platforms for larger investors right now. On the platform, you can invest in commercial and residential real estate projects. All loans are secured with a mortgage and have a maximum LTV of 70%. There are no fees for investors. The main disadvantages of Letsinvest are the short track record and only a small amount of available loans. Currently, the average annual return on the platform is great at around 8-9%.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Letsinvest review

Are you considering investing via Letsinvest? Then read on. We’ve written this Letsinvest.eu review to help investors determine if Letsinvest is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this Letsinvest review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our Letsinvest review:

- What is Letsinvest?

- Key features

- Who can use Letsinvest?

- How safe is Letsinvest?

- Our experience with Letsinvest

- Letsinvest reviews on Trustpilot

- Best Letsinvest alternatives

- Conclusion of our Letsinvest review

What is Letsinvest?

Letsinvest is a real estate crowdfunding platform that allows you to invest in commercial and residential projects.

Letsinvest offers a convenient and efficient way to get exposure to real estate without having to buy or manage properties yourself. The platform offers competitive returns and low minimum investment amounts, making it an ideal way to diversify your investment portfolio.

Letsinvest was launched in 2020 and is operated from Vilnius, Lithuania. The platform is licensed and supervised by the Bank of Lithuania.

Since its launch, the platform’s investors have funded over €23,226,325 worth of real estate projects.

Letsinvest is a marketplace that helps real estate developers get funding from investors. It’s an independent organization from real estate developers.

Investors on the platform can invest in buy-to-let investments and earn from both rental yield and capital appreciation. The combined average annual return is around 8–9%.

With as little as €100, you can open an account and start investing at https://letsinvest.eu/.

Letsinvest statistics:

| Founded: | 2020 |

| Investment Type: | Real Estate |

| Investment Period: | 6 – 24 Months |

| Investments Funded: | € 23,226,325 + |

| Letsinvest Users: | 1,875 + |

| Minimum Investment: | € 100 |

| Maximum Investment: | Unlimited |

| Letsinvest Interest Rate: | 9.84% |

| Loss of Investors’ Money: | 0% |

How Letsinvest works:

Letsinvest operates on two fronts. Letsinvest must both identify relevant projects for its platform and find investors to fund these projects.

Their real estate experts do due diligence checks on every given property before it is placed on the platform to determine whether or not it is a good idea. Profitability, location, and development experience are among the factors considered.

When a project becomes available on Letsinvest, investors can invest in it (see current projects). If you opt to acquire a project, you will receive an interest rate from the loan.

Frequently asked questions:

Key features

We have already taken a look at some of the reasons why Letsinvest has become a popular choice among both project originators and investors.

In the following part of our Letsinvest review, we take a closer look at some of the key features that make it nice to invest via the real estate crowdfunding platform:

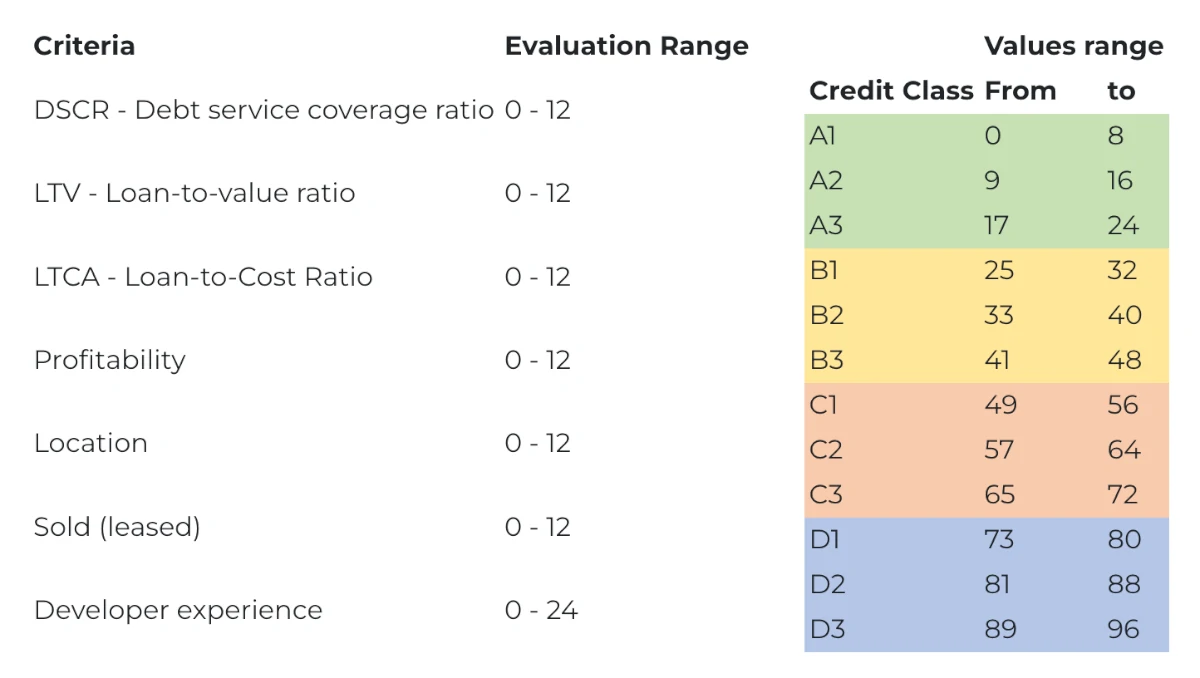

1. Letsinvest risk class evaluation

On Letsinvest the risk class evaluation is conducted by real estate experts using the following evaluation criteria:

2. Letsinvest VIP membership

Letsinvest is one of the real estate crowdfunding platforms that is not only focusing on small investors.

If you are a large investor with over €50,000 in investments, you can expect to get a VIP membership with a more personalized investment experience with a personal portfolio manager and a tailored investment plan.

The platform has real estate projects that start from €100,000, which makes the platform very attractive for larger investors.

Who can use Letsinvest?

Both individuals and companies can use Letsinvest.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Be a resident of a country in the European Economic Area

- Be at least 18 years old

If you live up to these requirements, then you can probably start investing via the platform.

Companies

It is also possible to invest with Letinvest via your company.

Only companies registered in the European Economic Area can invest via Letsinvest.

Available countries

It is possible to invest via Letsinvest if you are a resident of any country in the European Economic Area (EEA). The website is available in English, Lithuanian, and German.

If you live from outside of the EU and want to invest in real estate crowdfunding, you should check out ReInvest24, EstateGuru, or Max Crowdfund.

How safe is Letsinvest?

To determine if Letsinvest is safe, we have looked at some of the potential upsides and downsides of investing via the platform in the following part of our Letsinvest review.

1. Letsinvest profitability

The company behind Letsinvest, 8 Stars, UAB, became profitable in 2021, with a net profit of €8,468.

2. Main risks

In the following, we go through some of the main risks of using Letsinvest that we have considered. Keep in mind that you should always do your own research before investing:

Loan default risk

With the properties on Letsinvest, there is a loan default risk. But all loans are secured with a mortgage with a maximum LTV of 70%.

Letsinvest bankruptcy risk

The risk of any company going bankrupt is always present. This is also the case with Letsinvest.

In the unlikely event that Letsinvest becomes insolvent, your investments are unaffected. This is due to the fact that the contract is between the investor and the real estate project developer. Letsinvest is simply facilitating the investments and doesn’t have access to your money.

The procedures are compliant with the best bank practices of the EU and the Bank of Lithuania.

Financial turndown risk

However you choose to invest in real estate, you take on risks related to real estate. This is also the case with Letsinvest.

Therefore, a financial turndown in real estate could affect your investments on Letsinvest due to the fact that a real estate crash could cause a decline in property values.

Is Letsinvest safe?

Overall, Letsinvest seems safe with mortgages on all loans and a maximum LTV of 70%.

Of course, there is a risk associated with investing via Letsinvest, but overall the investments are fairly conservative.

Our experience with Letsinvest

Our overall impression of Letsinvest is really positive. When compared to its competition, the platform is undeniably good.

The team experience and user-friendliness of the real estate crowdfunding site are great. The platform is ideal for larger investors, but it is also suitable for smaller investors.

We also believe that the Letsinvest marketplace provides a great balance between risk and profit.

At present, there is nothing worrisome regarding the platform.

Letsinvest reviews on Trustpilot

Trustpilot is a great place to learn what other investors think about Letsinvest. We have collected some relevant Letsinvest reviews from Trustpilot for you to take a closer look at:

There are currently no relevant Trustpilot reviews of Letsinvest.

Best Letsinvest alternatives

Not sure Letsinvest is the right choice for you? Then there are also some good Letsinvest alternatives to consider. The following are some of our favorites:

- PeerBerry (consumer lending platform)

- ReInvest24 (real estate crowdfunding platform)

- AxiaFunder (litigation crowdfunding platform)

- Debitum (P2B lending platform)

Even if you use Letsinvest, it might actually be a good idea to take a closer look at some of the above platforms. By using more than one of the best P2P lending platforms in Europe, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our Letsinvest review

Letsinvest is one of the best real estate crowdfunding platforms for investing in commercial and residential projects.

All projects are secured with a mortgage and have a maximum LTV of 70%. There are zero fees for investors on the platform.

The main disadvantages of using Letsinvest are the limited number of loans offered on the platform and Letsinvest’s short track record.

The average annual return on the platform is also quite good at around 8-9%.

Letsinvest is an excellent choice for a real estate investment platform. The platform is especially good for large investors seeking larger investments in real estate projects.