Max Crowdfund review 2023

Is Max Crowdfund a great platform for real estate crowdfunding? Find out in our Max Crowdfund review below:

Max Crowdfund

Pros:

Cons:

Review summary:

Max Crowdfund is one of the best international real estate crowdfunding platforms right now. On the platform, you can invest in real estate loans with over 1,000 other investors. All assets are backed with collateral. The projects yield an annual return of around 9%. To this date, there has been an impressive 0% default rate on the platform. One of the platform’s downsides is the lag of the auto-invest feature, which means that you will have to manually pick all investments.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Max Crowdfund review

Are you considering investing via Max Crowdfund? Then read on. We’ve written this MaxCrowdfund.com review to help investors determine if Max Crowdfund is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this Max Crowdfund review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our Max Crowdfund review:

- What is Max Crowdfund?

- Key features

- Who can use Max Crowdfund?

- How safe is Max Crowdfund?

- Our experience with Max Crowdfund

- Max Crowdfund reviews on Trustpilot

- Best Max Crowdfund alternatives

- Conclusion of our Max Crowdfund review

What is Max Crowdfund?

Max Crowdfund is an international real estate crowdfunding platform. Users on the platform can invest in real estate projects in the Netherlands, Germany, Belgium, and the UK.

Max Crowdfund offers a convenient and efficient way to get exposure to real estate without having to manage properties yourself. The platform offers competitive returns and low minimum investment amounts, making it an ideal way to diversify your investment portfolio.

Here are some of the projects from the Max Crowdfund platform:

The platform is owned by Max Property Group. The owner is a multi-national real estate investment group from Rotterdam in the Netherlands. They started operations in 2016.

Max Crowdfund was launched in 2020 after being approved by the Dutch financial regulators. Since its launch, the platform has gained a lot of traction in the P2P lending community.

Currently, there are over 11,192 investors on Max Crowdfund. The average investor on the platform has invested €1,852. This is split between 10 to 11 investment projects, with an average annual net return of 10.29%.

With as little as €100, you can open an account and start investing at https://maxcrowdfund.com/.

Max Crowdfund statistics:

| Founded: | 2019 |

| Loan Type: | Real Estate |

| Loan Period: | 6 – 120 Months |

| Loans Funded: | € 50,799,900 + |

| Max Crowdfund Users: | 11,192 + |

| Minimum Investment: | € 100 |

| Maximum Investment: | Unlimited |

| Max Crowdfund Interest Rate: | 10.29% |

| Loss of Investors’ Money: | 0% |

Max Crowdfund fees:

Max Crowdfund charges a 0.1% monthly administration fee based on your outstanding investments. This means that you are charged 1.2% in fees on a yearly basis.

If the annual gross interest rate is 10%, you ultimately end up with a return of 8.8% per year.

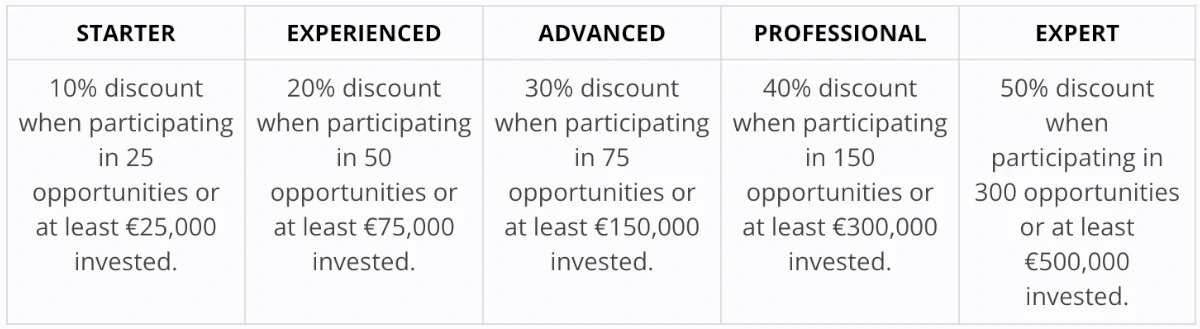

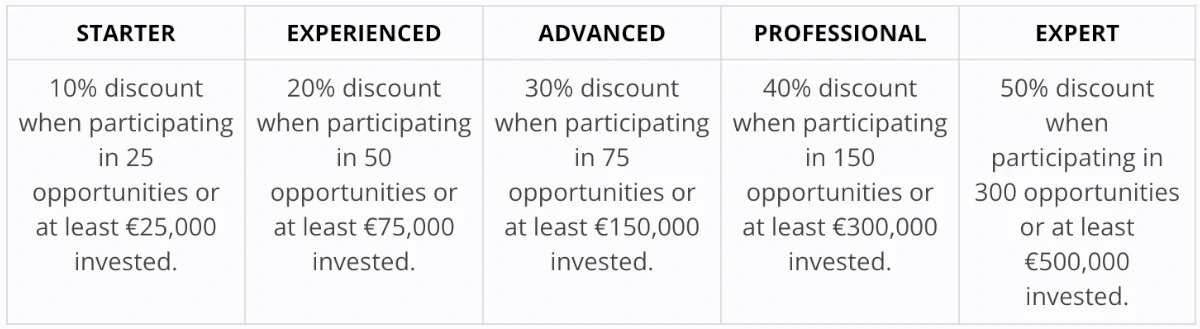

Large and active investors can save up to 50% on fees with the Max Crowdfund loyalty program.

Here is what you can save on the admin fee depending on how you invest on the platform:

How Max Crowdfund works:

Max Crowdfund works like most other real estate crowdfunding platforms.

They have a two-sided business model. On one side they have to attract fundraisers seeking funds. On the other side, they have to attract investors to fund these properties.

The benefits for both parties are described in the following illustration:

Frequently asked questions:

Key features

We have already taken a look at why Max Crowdfund has become a popular choice among project originators and investors.

In the following part of our Max Crowdfund review, we take a closer look at some of the key features that make it easy to invest via the real estate crowdfunding platform:

1. Max Crowdfund Risk Rating Model

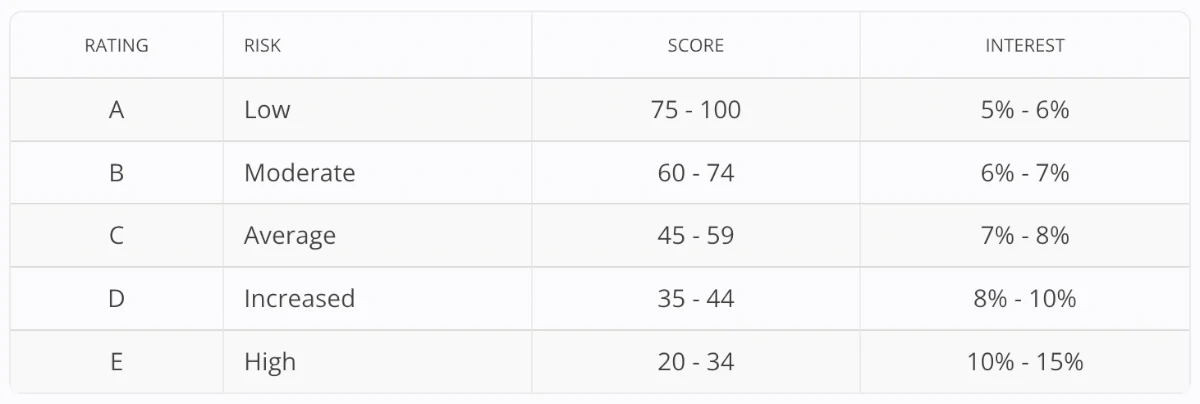

One of the key features is the Max Crowdfund Risk Rating Model. The fact that the platform has a publicly available model for how risk is measured is a huge plus.

There are 5 ratings from A to E. A implies the lowest risk and E the highest risk. The higher risk, the higher return.

In the following table (from the website), it is shown how the rating correlates with the interest you will get:

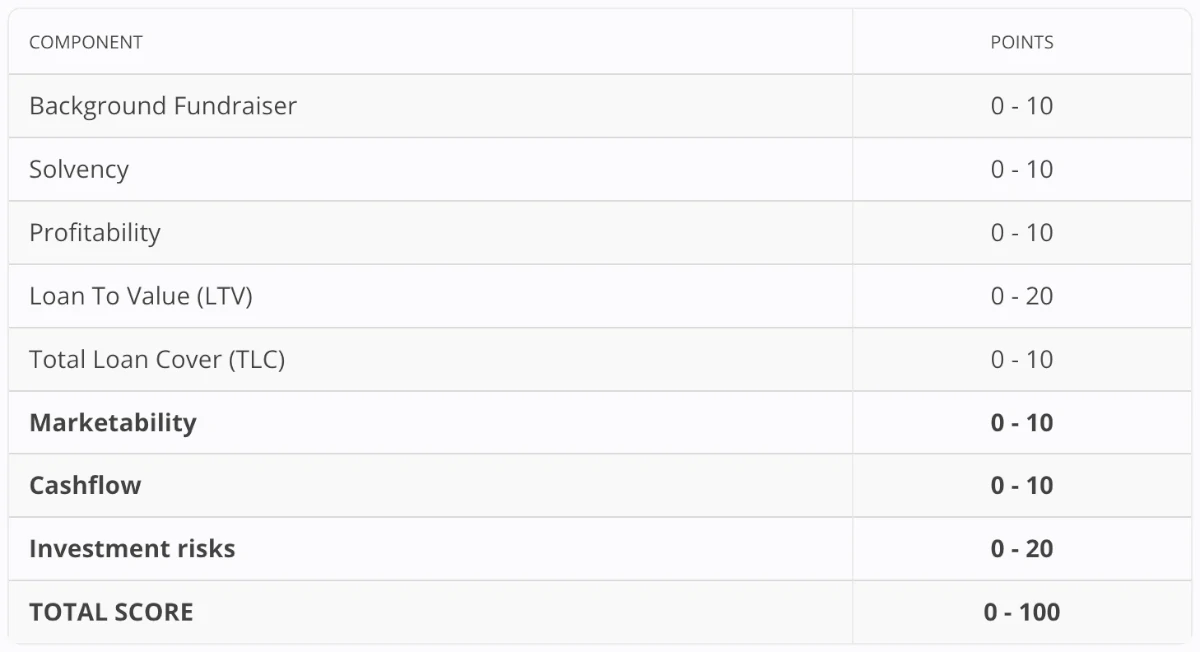

The score is measured by background fundraiser, solvency, profitability, LTV, TLC, marketability, cash flow, and investment risks:

You can use the Max Crowdfund Risk Rating Model to get an idea of the risk level of any particular project on the platform.

2. Max Crowdfund loyalty program

Max Crowdfund has a loyalty program that aims to reward the largest and most active investors on the platform.

By investing more or participating in more investment opportunities, you can save money on the standard monthly administration fee of 0.1%.

Who can use Max Crowdfund?

Both individuals and companies can use Max Crowdfund.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Be at least 18 years old

- Comply with KYC

- Link to a bank account

If you live up to these requirements, then you can probably start investing via the platform.

Companies

If you run a company seeking funds for your real estate projects you can also use Max Crowdfund.

In order to get started with crowdfunding your projects, you can apply for funding on the website.

Available countries

To our knowledge, it is possible to invest via Max Crowdfund in most countries around the world. All countries from Europe are accepted.

To prevent tax evasion, money laundering, and other illegal activities, some countries and nationalities might be restricted from the real estate crowdfunding platform.

How safe is Max Crowdfund?

To determine if Max Crowdfund is safe, we have taken a look at some of the potential upsides and downsides of investing via the platform in the following part of our Max Crowdfund review.

1. Max Crowdfund profitability

We haven’t been able to find an annual report to figure out the financial situation of either Max Crowdfund or the owner, Max Property Group. For increased transparency for investors, we hope to see publicly available annual reports in the near future.

2. Main risks

In the following, we go through some of the main risks of using Max Crowdfund that we have considered. Keep in mind that you should always do your own research before investing:

Loan default

There is always the risk that the borrower can’t repay the real estate loan. In this case, your money is at risk.

Max Crowdfund does a lot to mitigate this risk. Let’s have a look at some of it:

- Before a project is accepted, thorough due diligence according to the Max Crowdfund Risk Rating Model.

- All loans are also secured with physical assets at a Loan-To-Value (LTV) of a maximum of 90%.

- The borrowers are also required to give a personal guarantee or business guarantee. The guarantee has to cover at least the difference between the loan amount and the execution value of the assets.

Max Crowdfund bankruptcy risk

There is also the risk of the real estate crowdfunding platform itself going bankrupt.

In the unlikely event that this happens, your funds should still be safe.

This is due to the fact that Max Crowdfund holds both investors’ money and collateral for investments in separate accounts from its main operations.

If Max Crowdfund folds, the investments will be managed by an appointed third-party administrator. This administrator will take over loan administration and payment processing.

This means that your investments would still be serviced in the event that Max Crowdfund goes into bankruptcy.

Financial turndown risk

However you choose to invest in real estate, you take on risks related to real estate. This is also the case with Max Crowdfund.

Therefore, a financial turndown in real estate could affect your investments at Max Crowdfund due to the fact that a real estate crash could cause a decline in property values.

Is Max Crowdfund safe?

Max Crowdfund seems fairly safe since the platform is regulated by Dutch financial regulators.

But the platform is still young with a short track record. This means that is very hard to get a full picture of the safety of the platform over a longer time period.

Since the investments are backed with collateral and the team behind the platform is very experienced, Max Crowdfund is a platform that is expected to thrive in the coming years.

Our experience with Max Crowdfund

Our overall experience with Max Crowdfund is very positive. If you compare the platform to competitors, they are definitely among the better platforms.

The real estate investment platform excels both in terms of team experience and user-friendliness. But we would have liked to see an option for auto-investing.

We also believe that there is a reasonable balance between risk and return on the Max Crowdfund platform.

Nothing is concerning about the platform at the moment.

Max Crowdfund reviews on Trustpilot

Trustpilot is a great place to learn what other investors think about Max Crowdfund. We have collected some relevant Max Crowdfund reviews from Trustpilot for you to take a closer look at:

Best Max Crowdfund alternatives

Not sure Max Crowdfund is the right choice for you? Then there are also some good Max Crowdfund alternatives to consider. The following are some of our favorites:

- PeerBerry (consumer lending platform)

- ReInvest24 (real estate crowdfunding platform)

- AxiaFunder (litigation crowdfunding platform)

- Debitum (P2B lending platform)

Even if you use Max Crowdfund, it might actually be a good idea to take a closer look at some of the above platforms. By using multiple P2P lending platforms, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our Max Crowdfund review

Max Crowdfund is one of the best international real estate crowdfunding platforms right now.

All loans are secured and the platform is regulated by Dutch financial regulators.

The team behind the Max Crowdfund has loads of experience in the real estate industry. This is very positive and gives a great outlook for the platform.

To this date, there has been an impressive 0% default rate on the platform. This witness of a quite safe platform.

The annual return on the platform is a bit lower than on other P2P lending platforms at around 9-10%. But both the risk also seems a bit lower.

One of the only downsides of the platform is the fact that there is no auto-investing option available. This means that you can’t automate your investments. Instead, you must pick investments manually.

Max Crowdfund is overall an excellent choice for a real estate investment platform.