PeerBerry review 2024

Is PeerBerry a great platform for P2P lending? Find out in our PeerBerry review below:

PeerBerry

Pros:

Cons:

Review summary:

PeerBerry is one of the most reliable P2P lending platforms in the industry and has a simple and easy-to-use platform. The platform offers a competitive return that has attracted thousands of investors. However, one of the major cons is the lack of a secondary market, which makes it difficult to get out of an investment before the loan matures. This drawback is offset by the fact that most loans on PeerBerry are short-term loans. PeerBerry is owned by a profitable company and therefore has more financial ballast than many of the unprofitable platforms on the market. The platform is highly sought after, leading to high demand for listed loans, often resulting in cash drag and reduced real returns even though PeerBerry lists around €2-4 million worth of loans daily. To address this, PeerBerry plans to onboard more lending companies in 2024.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our PeerBerry review

Are you considering investing via PeerBerry? Then read on. We’ve written this PeerBerry.com review to help investors determine if PeerBerry is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this PeerBerry review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our PeerBerry review:

- What is PeerBerry?

- Key features

- Who can use PeerBerry?

- How safe is PeerBerry?

- Our experience with PeerBerry

- PeerBerry reviews on Trustpilot

- Best PeerBerry alternatives

- Conclusion of our PeerBerry review

What is PeerBerry?

PeerBerry is one of the best peer-to-peer lending platforms in Europe for short-term loans. It is a P2P lending marketplace that connects borrowers and investors from all over the world. The company is run by a team of experienced financial professionals with the goal of making online lending more accessible and efficient.

PeerBerry was launched on November 1, 2017. It is registered in Croatia, but the headquarters are based in Vilnius, Lithuania.

PeerBerry has become one of the leading P2P lending platforms in the industry, offering a wide range of loans for both personal and business purposes. You can use PeerBerry to invest in a mix of different loan types, including personal loans, business loans, real estate, leasing, and more.

The loans on PeerBerry primarily originate from Aventus Group and its subsidiaries. But in recent years, more loan originators have been connected to the growing marketplace including Gofingo, Lithome, and SIBgroup. Most lending groups on PeerBerry are profitable and have more than 10 years of experience. This indicates that PeerBerry is strict in the loan originator selection process and focuses on high-quality partnerships. This adds to the credibility of the platform.

Before PeerBerry was launched Aventus Group and its subsidiaries used Mintos for a few months in 2016 to allow P2P investors to invest in their loans. But they decided to get off Mintos to make their own platform instead. This decision resulted in PeerBerry.

Since the launch of PeerBerry, the platform has grown to have over 80,000 investors. Investors at PeerBerry earn an average return of 11.18% for their investments. This has resulted in over €30,000,000 in interest paid to PeerBerry’s investors. Compared to many other platforms, the return on PeerBerry has been very stable over the years.

With as little as €10, you can start investing at https://peerberry.com/.

PeerBerry statistics:

| Founded: | 2017 |

| Loan Type: | Consumer |

| Loan Period: | 1 – 60 Months |

| Loans Funded: | € 2.400.000.000 + |

| PeerBerry Users: | 80.000 + |

| Minimum Investment: | € 10 |

| Maximum Investment: | Unlimited |

| PeerBerry Interest Rate: | 11.18% |

How PeerBerry works

PeerBerry works by connecting loan originators to the platform. The loan originators then make already issued loans available for investment. These are mainly loans from Aventus Group, Gofingo, Lithome, and SIBgroup.

By investing in the loans, the loan originators gain new capital. As a result, they can issue more loans and thereby grow their business further. In this way, a win-win situation is created between the loan originators and investors like you.

Key features

We have already taken a look at some of the reasons why PeerBerry has become a popular choice among investors. In the following, we take a closer look at some of the key features that make it easy to invest via the platform:

1. PeerBerry buyback guarantee

Most loans on PeerBerry are covered by a buyback guarantee. When a loan has a buyback guarantee it means that the loan originator will have to buy back the loan from you in case the borrower is unable to pay off his debt.

At PeerBerry, the buyback guarantee comes into effect if the repayment of a loan is over 60 days delayed. On their website, you can see which loans are covered as well as which loans are not covered by the buyback guarantee.

If you want to invest very passively, you can also utilize the PeerBerry auto-invest to only invest in loans with a buyback guarantee.

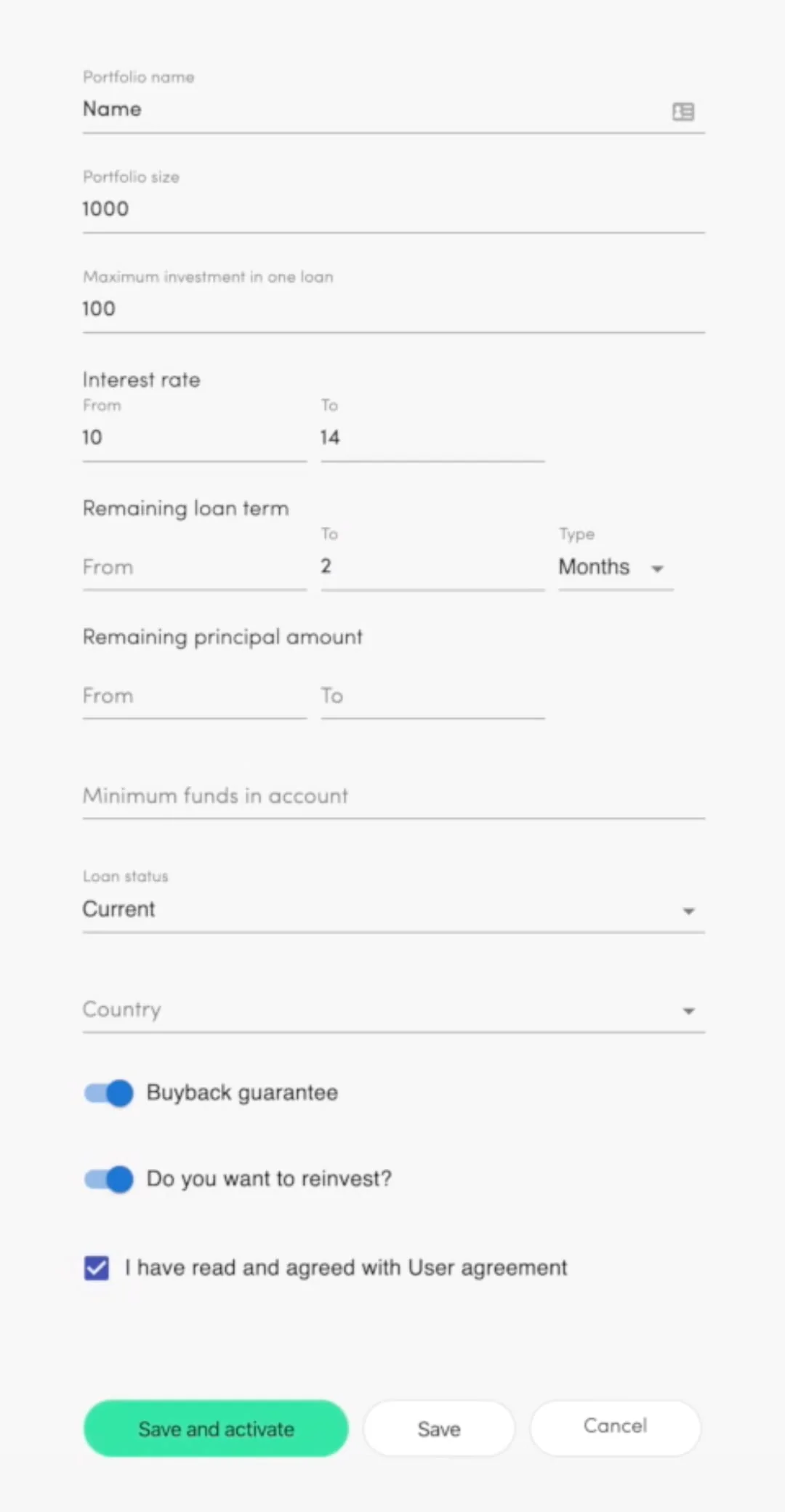

2. PeerBerry auto-invest

At PeerBerry.com you will find a user-friendly auto-invest feature. By using it, you avoid having to select loans to invest in manually.

To use their auto-invest strategy, follow this process:

- Make sure you have signed up

- Log in to your account

- Click “Auto Invest”

- Click “Create new Auto Invest portfolio”

From here you can set up your PeerBerry auto-invest settings:

When setting up your PeerBerry auto-invest strategy, you can choose how much of your portfolio to invest and how much in each loan. You can also set limits on what interest rates you are interested in.

If you want to invest exclusively in loans in certain countries or from certain loan originators, then this can also be done.

Furthermore, you can choose to invest solely in loans with a buyback guarantee and the money will automatically be reinvested.

Just play around with the auto-invest feature a bit, and you will soon get the hang of how it works.

3. PeerBerry Loyalty Program

As one of the few Peer-to-Peer investment sites, PeerBerry has a Loyalty Program. This program rewards people who invest a lot of money for longer periods on the platform. Depending on how much money you have invested on the platform, you can earn a 0.5-1% extra return through the Loyalty Program.

To benefit from the PeerBerry Loyalty Program, you must meet the following requirements:

- Have been a member of PeerBerry for more than 90 days

- Having over €10,000 on the platform

Through the PeerBerry Loyalty program, you can earn the following rewards:

- Silver: When you invest a minimum of € 10,000 you will get + 0.5% on your investments.

- Gold: When you invest a minimum of € 25,000 you will get + 0.75% on your investments.

- Platinum: When you invest a minimum of € 40,000 you will get + 1% on your investments.

For example, let’s say you are a platinum investor which means that you will earn + 1% on your investments. So investments that will usually yield 11% returns will give you 11% + 1%. So instead of getting an 11% return, you will get a 12% return. In other words, it is well worth it to have more money invested via PeerBerry.

4. PeerBerry tax report

As the taxation of the income for each investor on the platform depends on the legislation of the country where the investor is a tax resident, PeerBerry does not withhold any taxes for private investors. Instead, it is the investor who is fully responsible for filing the taxes.

PeerBerry makes it easy to handle your taxes on investment gains on the platform. If you go to your account you will easily be able to generate a PeerBerry tax report so you can file your taxes.

5. PeerBerry referral bonus

PeerBerry offers a 0.5% cashback bonus for new investors who get referred to its platform.

We have received an affiliate link from PeerBerry, which means that you can get a 0.5% bonus for 3 months by using our refer-a-friend link.

All you have to do to get the PeerBerry cashback is to activate the bonus by clicking the button below (no referral code or promo code needed):

Who can use PeerBerry?

Both individuals and organizations can invest via PeerBerry.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Being at least 18 years old

- Having a bank with AML/CFT equivalent to the EU

If you live up to these requirements, then you can probably start investing via the platform.

Organizations

If you run an organization, you can also use PeerBerry for your investments. Upon signing up, simply select that you want to create an account for your company.

Apart from this, the sign-up process for a company is very similar to the sign-up process for individuals.

Available countries

PeerBerry is primarily targeted to Europe, as the loans are handled in Euro. Therefore, the vast majority of investors are also from Europe. However, we also know people from Saudi Arabia and Canada who are using the Peer-to-Peer lending platform. If you come from a country other than these, try contacting PeerBerry and find out if you can use their platform. Alternatively, you can also find out if you can use PeerBerry by just trying to sign up on the platform.

How safe is PeerBerry?

To determine if PeerBerry is safe, we have taken a look at some of the potential upsides and downsides of investing with PeerBerry.

1. PeerBerry profitability

PeerBerry has been a profitable P2P lending platform since its inception. Here is an overview of the historic profitability of the platform:

- 2018: Net profit of €98,830

- 2019: Net profit of €284,550

- 2020: Net profit of €142,174

- 2021: Net profit of €254,301

- 2022: Net profit of €663,455

The fact that PeerBerry is profitable lowers the overall platform risk substantially as the risk of the platform going bankrupt is lower than for unprofitable platforms.

Aventus Group, the owners of Peerberry, has been profitable since 2009, which adds to the overall financial strength of the platform. Since the group was founded it has experienced high growth and is today a very solid company. Due to the financial strength of the group, PeerBerry should also be reasonably secure to invest through.

PeerBery is very transparent about its financials and you can find the most recent financial reports on the platform’s website.

2. Main risks

In the following, we go through some of the main risks of using PeerBerry that we have considered:

Loan default risk

When you invest in P2P loans, there is a risk that the borrower will not be able to repay his loan. In that case, your investment is usually lost.

However, most loans at PeerBerry have a buyback guarantee that can secure you against this type of event.

The best way to hedge against loan default risk is to invest in many different loans. In addition, it may be a good idea to choose loans with a buyback guarantee. You can see on their website, which loans are covered.

Loan originators risk

The loan originators also pose a risk to investors. If they are not in control of their finances, have poor management, or the like, then they run the risk of going bankrupt like any other business.

In PeerBerry’s case, the loan originators are primarily subsidiary companies of Aventus Group. The group seeks, through IT solutions, that only the most qualified borrowers are allowed to borrow via their subsidiaries.

As Aventus Group is responsible for most of the entire supply chain, it is also in their best interest to minimize the loan originator risk.

PeerBerry bankruptcy risk

As with any business, there is a risk of PeerBerry going bust. But since PeerBerry has been profitable since its inception and is also owned by Aventus Group which has been profitable since 2009, the likelihood of this happening is probably not that big.

Of course, the risk of bankruptcy will always be there. Therefore, you should also consider how this could affect your investments.

Financial turndown risk

As P2P investing is a newer thing in the investment world, it can be difficult to predict how a financial turndown would affect this form of investment. As a starting point, it is, therefore, a really bad idea to invest your entire investment portfolio in P2P investments.

Therefore, many investors also choose to diversify into more traditional forms of investment such as equities, bonds, and traditional real estate.

Since investing is an individual thing, we do not know what will be best for you. But if you put together your investment portfolio, make sure that it reflects your knowledge of the investments in it, as well as your risk appetite. If in doubt about how to do so, make sure to seek help from a professional investment planner.

Is PeerBerry safe?

Since PeerBerry is owned by a profitable group, investments at PeerBerry are probably less risky than at many of the unprofitable platforms.

However, we will probably be a little cautious about investing in loans outside the EU due to the indirect investment structure. Furthermore, other factors such as lack of knowledge about how a financial turndown will affect the P2P lending industry are also risk factors that are worth considering.

Our experience with PeerBerry

We are very positive about PeerBerry. Everything from their signup process to investing in their platform is truly easy.

It is easy to both deposit funds, and make a withdrawal from your account. Both can be done with your bank account. As most loans on PeerBerry are very short-term, it is possible to withdraw most funds within 30-60 days.

However, one of the only things that we are not that fond of is the lag of a secondary market. Due to that, one has to keep their investments until the loan matures.

There have been very few times during the platform’s lifetime when investors have experienced a cash drag on PeerBerry. This means that there are very few times with no loans available for investment. The fact that your funds can be fully invested most of the time is very positive and yields better investment results.

Due to the lag of a secondary market, we prefer a platform like Mintos which has all the features of PeerBerry and more.

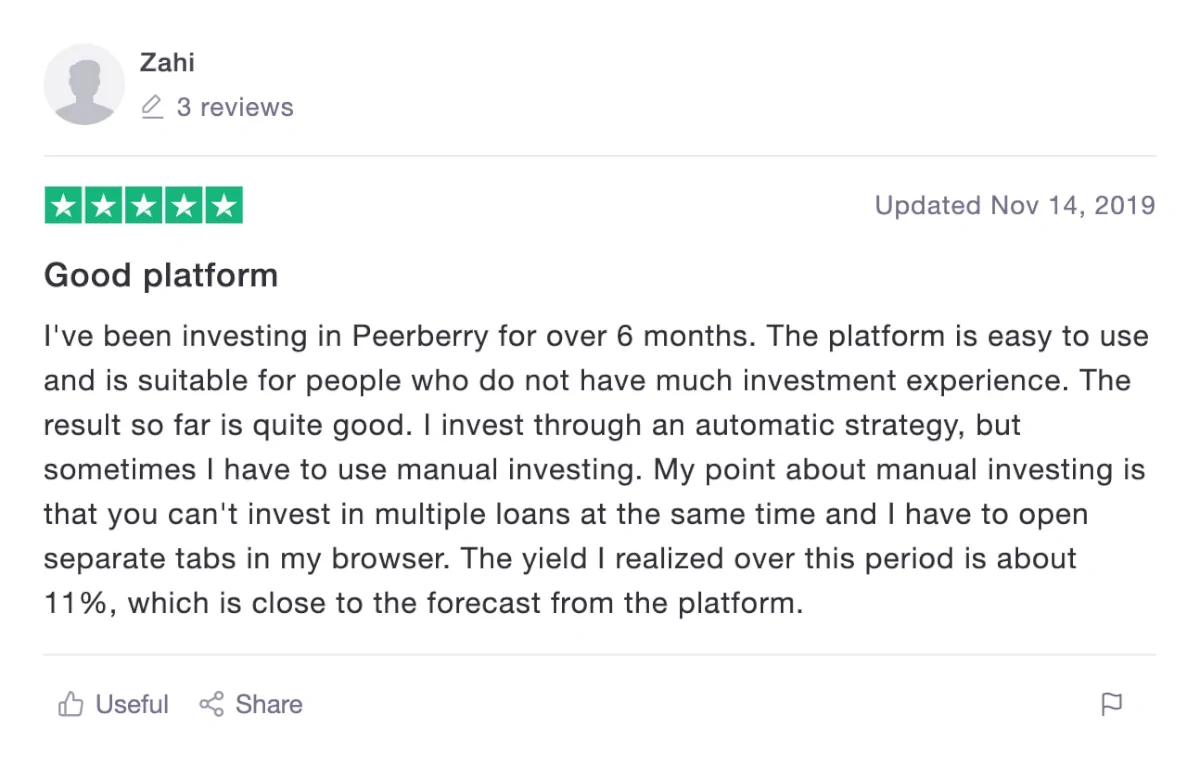

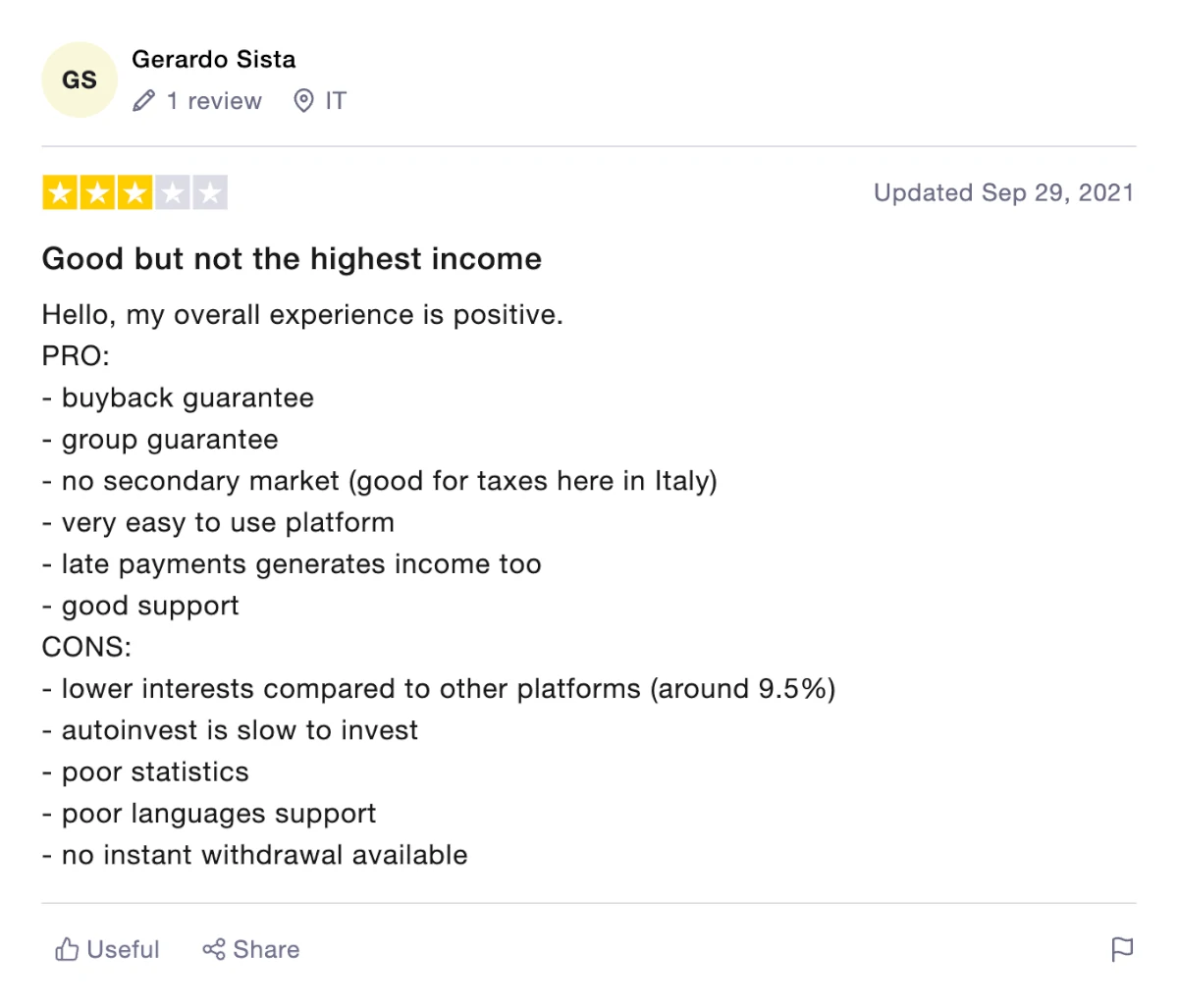

PeerBerry reviews on Trustpilot

Trustpilot is a great place to learn what other people think of PeerBerry. We have collected relevant PeerBerry reviews from Trustpilot for you to take a closer look at:

Best PeerBerry alternatives

Not sure PeerBerry is the right choice for you? Then there are also some good PeerBerry alternatives to consider. The following are some of our favorites:

Even if you use PeerBerry, it might be a good idea to take a closer look at some of the above platforms. By using multiple platforms, you can reduce your platform risk and diversify your portfolio further.

PeerBerry or Mintos

A lot of investors have asked whether they should choose PeerBerry or Mintos (the biggest crowdlending platform in Europe) as their first platform. In the following, we review what distinguishes PeerBerry from Mintos:

Both platforms can be excellent choices, but in recent years, more and more investors on forums, blogs, and social media like Reddit, YouTube, Twitter, and Facebook have started favoring PeerBerry over Mintos.

The main reason why investors would choose Mintos over PeerBerry is the fact that Mintos has a secondary market that makes early exit very easy. This feature is yet to come at PeerBerry.

At the same time, Mintos has more features, but the platform can also be more confusing at first.

Conclusion of our PeerBerry review

PeerBerry is a reputable peer-to-peer lending platform that offers investors a straightforward and user-friendly experience. With a competitive return rate, it has become a popular choice for many investors looking to grow their money.

PeerBerry is owned by a profitable company, which adds a layer of financial stability and trust. This sets it apart from other platforms that may be struggling financially.

PeerBerry’s focus on short-term loans provides a quick turnaround on investments, which can be appealing to those seeking liquidity. However, the platform lags a secondary market which might be a thing to consider for some investors as it limits investors’ ability to exit their investments before the loan matures. This lack of liquidity can be a concern for some investors who value flexibility in their investments.

A notable drawback of PeerBerry is that the demand for loans from investors on PeerBerry often outpaces the supply in the marketplace. This often leads to cash drag and reduced real returns even though PeerBerry lists around €2-4 million worth of loans daily. To address this issue, PeerBerry plans to add at least 10 new lending companies to the platform in 2024.

In conclusion, PeerBerry is a reliable platform with strong financial backing and competitive returns. While the absence of a secondary market and potential cash drag are factors to consider, the platform’s overall performance and user-friendly interface make it a solid choice for investors looking to diversify their portfolios through peer-to-peer lending.