Profitus review 2023

Is Profitus a great platform for real estate crowdfunding? Find out in our Profitus review below:

Profitus

Pros:

Cons:

Review summary:

Profitus is one of the best crowdfunding platforms for investing in real estate projects right now. On the platform, you can invest in business and real estate loans from Lithuania. 100% of the projects are secured with a mortgage. There are no fees for making investments on the platform, but selling on the secondary market costs 2%. Currently, the average annual return on the platform is great at around 10%. If you are looking for a regulated real estate crowdfunding platform with exposure to Lithuania, Profitus is the best option.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Profitus review

Are you considering investing via Profitus? Then read on. We’ve written this Profitus.com review to help investors determine if Profitus is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this Profitus review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our Profitus review:

- What is Profitus?

- Key features

- Who can use Profitus?

- How safe is Profitus?

- Our experience with Profitus

- Profitus reviews on Trustpilot

- Best Profitus alternatives

- Conclusion of our Profitus review

What is Profitus?

Profitus is a real estate crowdfunding platform that allows you to invest in property-backed investments in the Baltic region.

The real estate crowdfunding platform has a team of seasoned specialists who meticulously review each loan request before it is placed on the Profitus marketplace.

Profitus is a convenient and efficient way to invest in real estate without having to buy or manage properties yourself. The platform offers competitive returns and low minimum investment amounts, making it an ideal way to diversify your investment portfolio.

Profitus was launched in 2018 and is operated from Vilnius, Lithuania. The platform is licensed and supervised by the Bank of Lithuania.

All loans on Profitus are secured with a mortgage, and Profitus helps investors by evaluating projects, administering financing, settling processes, and more.

Since its launch, the platform’s investors have funded over €131,188,040 worth of real estate projects.

You can open an account at https://www.profitus.com/ and begin investing with as little as €100.

Profitus statistics:

| Founded: | 2017 |

| Investment Type: | Real Estate |

| Investment Period: | 3 – 36 Months |

| Investments Funded: | € 117,800,000 + |

| Profitus Users: | 8,441 + |

| Minimum Investment: | € 100 |

| Maximum Investment: | Unlimited |

| Profitus Interest Rate: | 10.25% |

| Loss of Investors’ Money: | 0% |

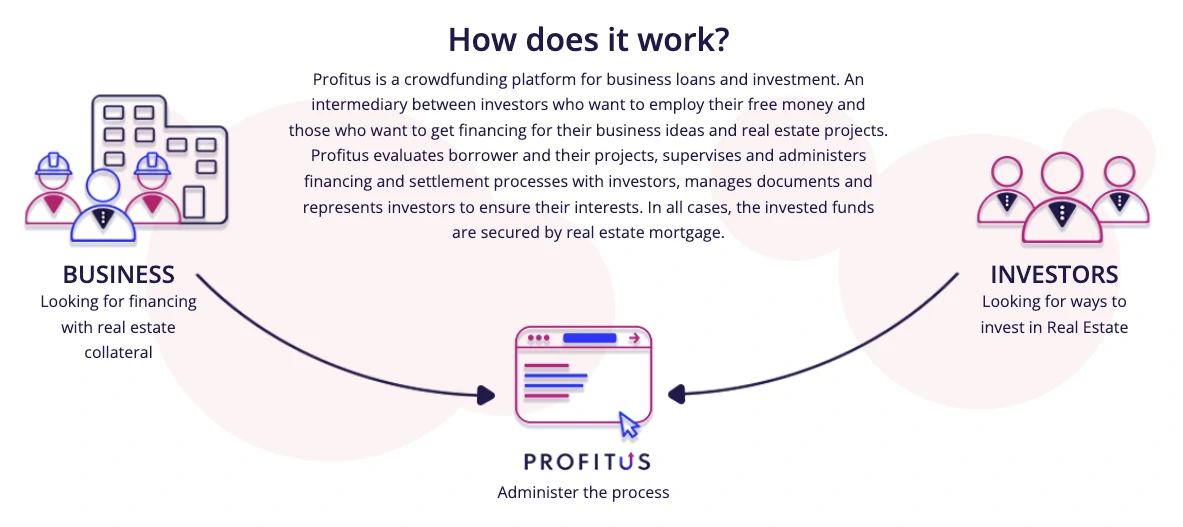

How Profitus works:

Profitus operates on two fronts. Profitus must both identify relevant projects for its platform and find investors to fund these projects.

The real estate specialists at Profitus assess the borrower and the projects they are working on, oversee and manage the financing and settlement processes with investors, manage the paperwork, and represent the investors to ensure their best interest.

When a project becomes available on Profitus, investors can invest in it (see current projects). If you opt to acquire a share in a loan, you will receive an interest rate from the loan itself.

Frequently asked questions:

Key features

We have already taken a look at some of the reasons why Profitus has become a popular choice among both project originators and investors.

In the following part of our Profitus review, we take a closer look at some of the key features that make it nice to invest via the real estate crowdfunding platform:

1. Profitus secondary market

Profitus has a secondary market for trading investments with other users of the platform.

It is possible to trade with active and overdue loans on the Profitus secondary market.

Something to be aware of is that you can first sell your investments bought from the primary market when the mortgage agreement has been signed. This means that there can be a short period where you can’t sell.

The fee for selling loans on the secondary market of Profitus is 2% of the final selling price. For buyers, there is no fee.

Who can use Profitus?

Both individuals and companies can use Profitus.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Be at least 18 years old

- Comply with KYC procedures

If you live up to these requirements, then you can probably start investing via the platform.

Companies

It is also possible to use your company to invest via Profitus.

Simply select “Legal entity” when signing up.

Available countries

Profitus are not targeting a specific area. This means that the platform is available worldwide.

All you have to do to sign up on Profitus is be able to comply with KYC procedures.

How safe is Profitus?

To determine if Profitus is safe, we have taken a look at some of the potential upsides and downsides of investing via the platform in the following part of our Profitus review.

1. Profitus profitability

Profitus doesn’t publish financial reports to verify the profitability of the company. This means that the profitability of the platform is unknown.

2. Main risks

In the following, we go through some of the main risks of using Profitus that we have considered. Keep in mind that you should always do your own research before investing:

Loan default risk

With the properties on Profitus, there is a loan default risk. But all loans are secured with a mortgage which lowers the chance of a 100% loss.

Profitus bankruptcy risk

The risk of any company going bankrupt is always present. This is also the case with Profitus.

In the unlikely event that Profitus becomes insolvent, your investments are unaffected. This is due to the fact that the contract is between the investor and the real estate project developer. Profitus is simply facilitating the investments.

Financial turndown risk

However you choose to invest in real estate, you take on risks related to real estate. This is also the case with Profitus.

Therefore, a financial turndown in real estate could affect your investments at Profitus due to the fact that a real estate crash could cause a decline in property values.

Is Profitus safe?

Profitus appears secure because of mortgages on all loans and being supervised by the Bank of Lithuania.

Investing at Profitus has risks, but the investments on the platform are not speculative in nature.

Our experience with Profitus

Our overall impression of Profitus is really positive. When compared to its competition, the platform is undeniably good. This is very evident on Trustpilot, where the platform has received a very high score.

The team’s experience and the user-friendliness of the platform are great. The real estate crowdfunding site is ideal for larger investors, but it is also suitable for smaller investors.

The balance of risk and profit also seems great on Profitus.

Currently, there is nothing worrisome about the platform.

Profitus reviews on Trustpilot

Trustpilot is a great place to learn what other investors think about Profitus. We have collected some relevant Profitus reviews from Trustpilot for you to take a closer look at:

Best Profitus alternatives

Not sure Profitus is the right choice for you? Then there are also some good Profitus alternatives to consider. The following are some of our favorites:

- PeerBerry (consumer lending platform)

- ReInvest24 (real estate crowdfunding platform)

- AxiaFunder (litigation crowdfunding platform)

- Debitum (P2B lending platform)

Even if you use Profitus, it might actually be a good idea to take a closer look at some of the above platforms. By using more than one of the best P2P lending platforms in Europe, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our Profitus review

Profitus is one of the best crowdfunding platforms for investing in business and real estate loans that are secured with a mortgage.

All projects are secured with a mortgage and most of the projects on Profitus have an LTV below 70%. Profitus is a regulated platform.

The average annual return on the platform is also quite good, at around 10%. This return is a bit lower than what can be found at ReInvest24, EstateGuru, and Bulkestate. But generally, the risk on Profitus is at the lower end, which means that you’d expect a lower return.

Profitus is one of the most highly-rated real estate crowdfunding platforms on Trustpilot. The platform has received an excellent rating.

Currently, Profitus is the best option for investing in real estate projects in Lithuania. The platform is also beginner-friendly.