Loanch review 2024

Do you want to know if Loanch is a reliable P2P lending platform? This detailed Loanch review will explore its pros and cons to assist you in determining whether it aligns with your financial objectives.

Loanch

Pros:

Cons:

Review summary:

Loanch is a promising P2P lending platform in Hungary that offers investors the opportunity to invest in consumer loans from Southeast Asia with attractive returns. It stands out with a 30-day buyback guarantee which is shorter than the industry standard of 60 days. Loanch also has an auto-invest option. However, the platform could improve transparency with financial reports and offer more loan originator options. The focus on short-term loans reduces the need for a secondary market, but an early exit option would provide more flexibility for investors. Overall, Loanch is a compelling choice for P2P investors looking to diversify in emerging markets.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Loanch review

Are you considering investing via Loanch? Then read on. We’ve written this loanch.com review to help you and other investors determine if Loanch is the right choice.

Below you will find an overview of the things that we will discuss more in detail in this Loanch review. Simply click on the links to jump directly to the thing you want to know more about.

Learn about this in our Loanch review:

- What is Loanch?

- Key features

- Who can use Loanch?

- How safe is Loanch?

- Our experience with Loanch

- Loanch reviews on Trustpilot

- Best Loanch alternatives

- Conclusion of our Loanch review

What is Loanch?

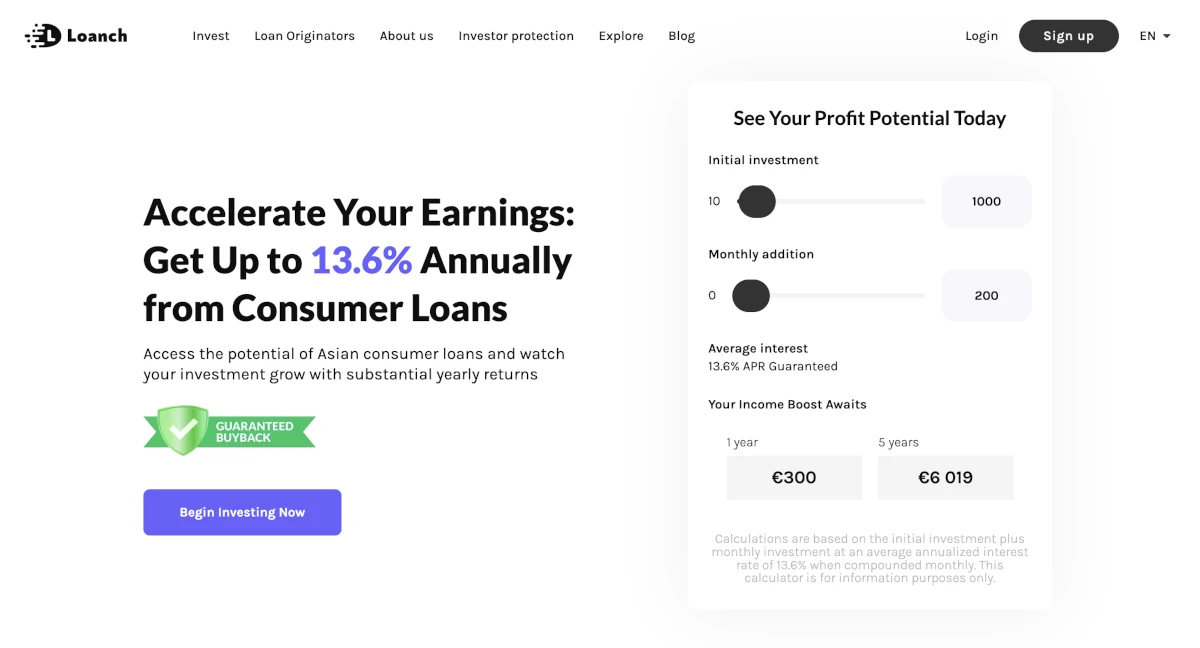

Loanch is a peer-to-peer lending platform that connects investors with licensed lenders to invest in consumer loans primarily in Southeast Asian markets.

Established in Hungary in December 2022, Loanch offers investors the opportunity to earn a potential annual return rate of up to 13.60% with a starting investment amount as low as €10.

The platform also provides a buyback obligation to reimburse investments with accumulated interest in cases of payment delays exceeding 30 days. Additionally, Loanch offers an auto-invest feature for users to automate their investment strategies based on their preferences.

Loanch is one of the smaller P2P lending platforms in Europe, but it has seen decent growth since its inception and currently has around 900 investors.

With as little as €10, you can open an account and start investing at https://loanch.com/.

Loanch statistics:

| Founded: | 2022 |

| Loan Type: | Short-term and installment loans |

| Loan Period: | 1 – 3 Months |

| Loans Funded: | € 2.000.000 + |

| Loanch Users: | 900 + |

| Minimum Investment: | € 10 |

| Maximum Investment: | Unlimited |

| Loanch Interest Rate: | 13.60% |

How Loanch works

Loanch works by connecting investors with licensed lenders who in turn provide consumer loans to borrowers in Southeast Asian markets. Investors can sign up for an account on the Loanch platform and browse through available loan opportunities to invest in.

Once an investor selects a loan to invest in, they can choose to fund the loan with their desired amount. The investor will then start earning interest on their investment based on the terms of the loan.

Investors can utilize the auto-invest feature to automate their investment strategies based on criteria such as loan type and interest rate.

Loanch also offers a buyback obligation feature, which means that if a borrower fails to make payments for more than 30 days, the loan originators will repurchase the loan and reimburse the investor’s principal investment along with any accumulated interest.

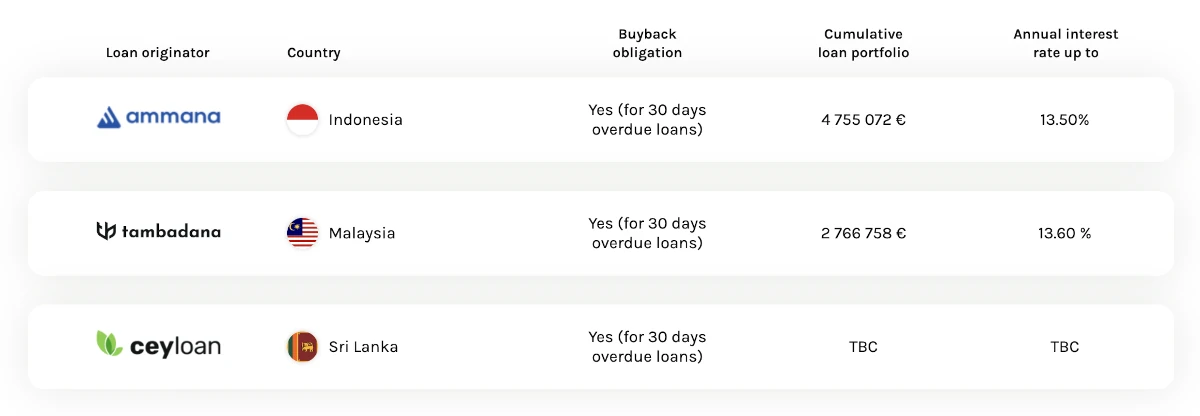

The current loan originators on Loanch are:

- Ammana

- Tambadana

- Ceyloan

Key features

Here are some of the key features that make it easy to invest via Loanch:

1. Loanch buyback guarantee

Loanch offers a 30-day buyback guarantee for loans from all loan originators.

Loanch’s buyback guarantee is a safety measure that provides investors with protection against potential defaults by borrowers. The unique aspect of Loanch’s buyback guarantee is that it offers investors a 30-day cushion period before the guarantee kicks in, unlike traditional guarantees that typically have a 60-day window.

This shortened timeframe enhances investor protection by enabling a quicker response to delinquent payments, minimizing the exposure to potential losses, and showcasing a proactive approach to risk management.

As an investor, you should be aware that a buyback obligation is only as strong as the financial stability of the loan originator. If a loan originator faces financial difficulties or goes bankrupt, the buyback guarantee may not hold, directly affecting the investors.

This means that it is essential for investors to conduct proper research and due diligence on loan originators to ensure they are financially stable and reliable, even when there is a buyback guarantee in place.

Despite the buyback obligation, it is also crucial for investors to diversify their investments across various loan originators and asset classes to mitigate potential risks.

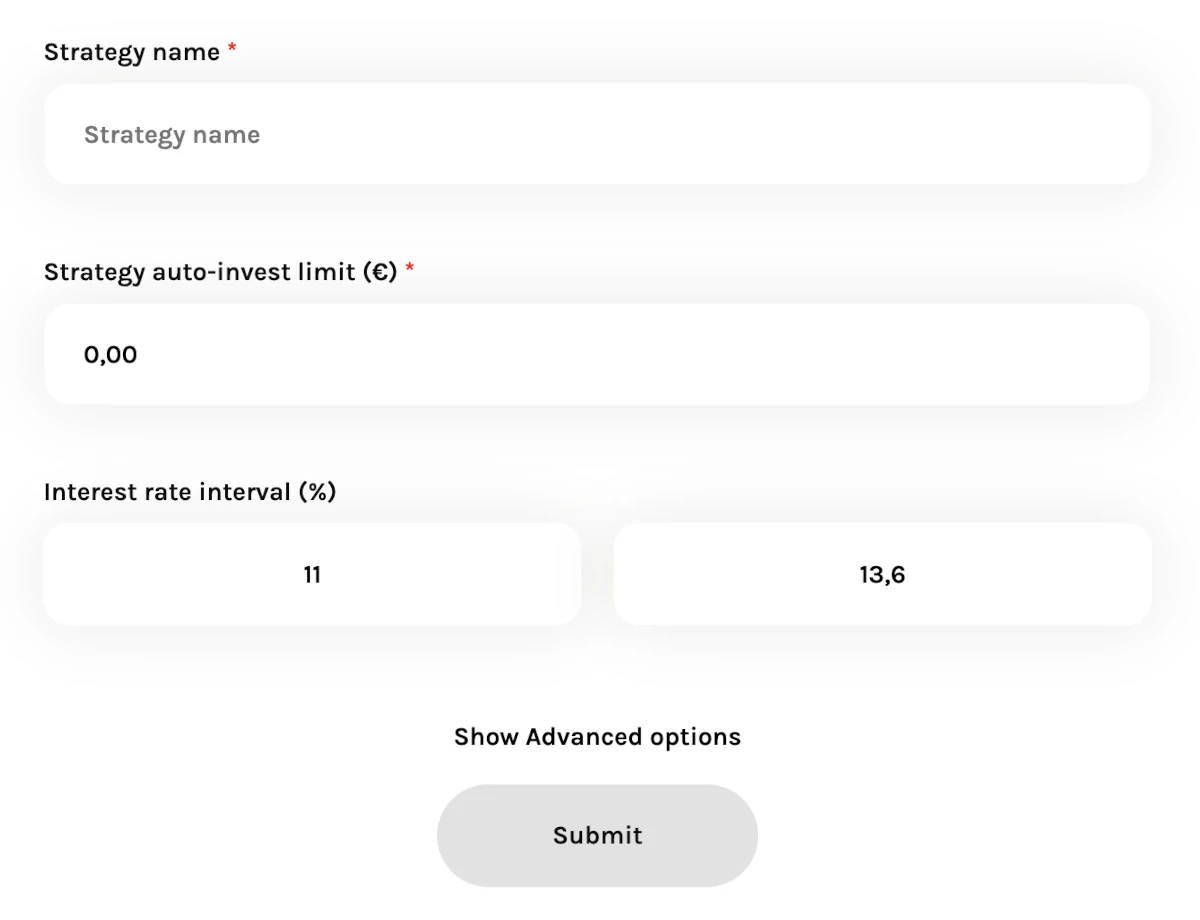

2. Loanch auto-invest

While it is possible to invest manually in loans on Loanch, most investors prefer not to spend time manually selecting loans. Here the Loanch auto-invest tool comes in handy.

To use the Loanch auto-invest tool, do the following:

- Sign up at https://loanch.com/

- Log in to your account

- Click “Invest now” in Actions section

- Select “Create new Auto Invest strategy”

- Decide how you want to invest

The automated investment strategy on Loanch is easy to set up. With the standard settings, you can select the auto-invest limit, and interest rate interval.

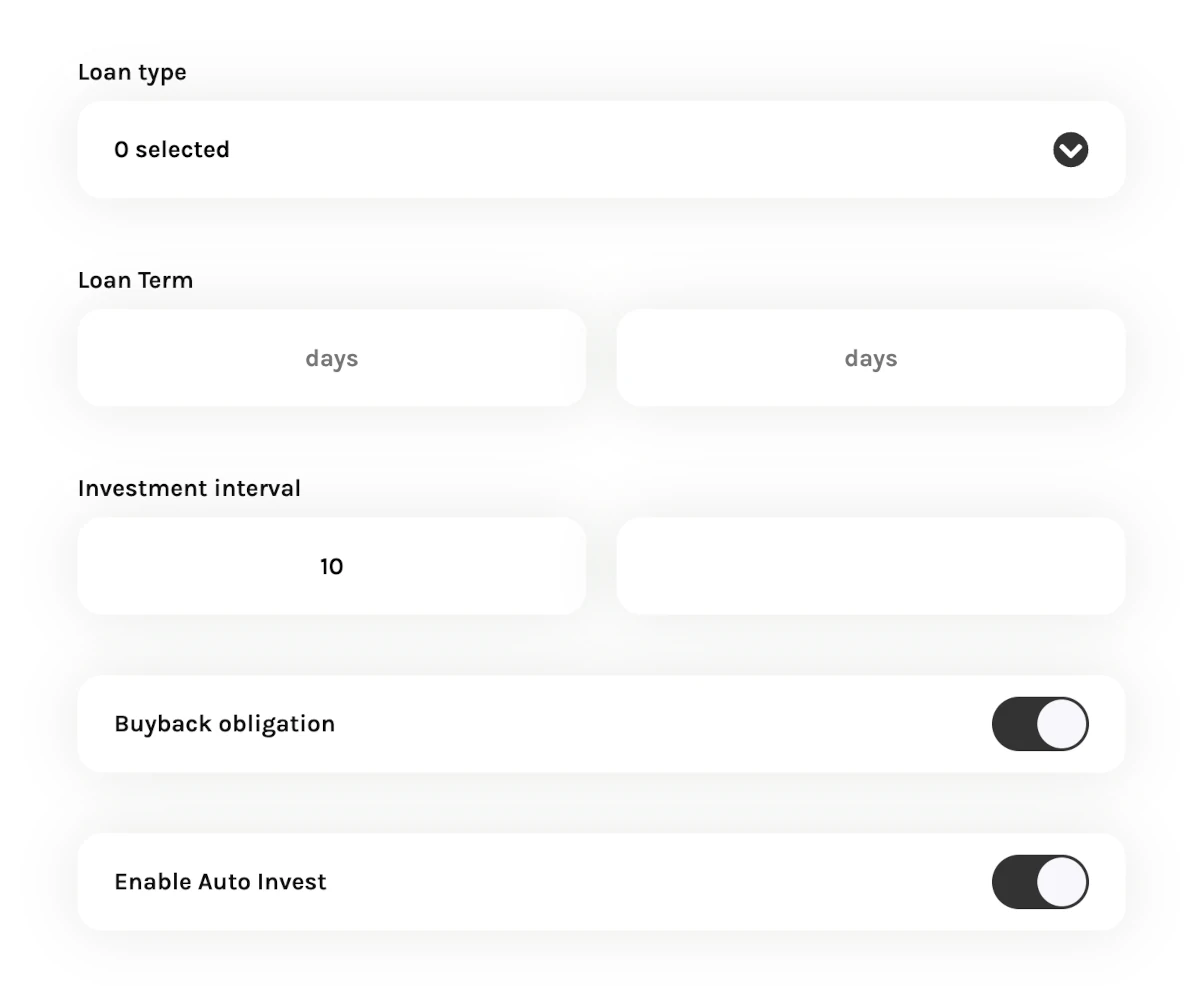

If you show advanced options you get some more options to choose from:

With the advanced options, you can select your preferred loan types, loan terms, investment intervals, if you want buyback obligation on the loans and more.

Who can use Loanch?

Investors who are at least 18 years old and have a bank account in the credit establishment of the EU or EEA can invest using Loanch.

To get started you must confirm your e-mail address and complete the identity verification process by providing either a passport or national ID. The process takes around 3 minutes to complete using Veriff.

Can companies invest?

Yes, companies can also invest with Loanch.

Available countries

Loanch is available in most countries as long as you have a bank account in the EU or EAA.

How safe is Loanch?

To determine if Loanch is safe, we have taken a look at some of the potential upsides and downsides of investing with Loanch.

1. Loanch profitability

Loanch is a new P2P lending platform and currently, it has not made any financial results available.

2. Main risks

In the following, we go through some of the main risks of using Loanch that we have considered:

Loan default risk

The loan default risk in P2P lending refers to the possibility that a borrower might be unable to meet their repayment obligations, causing a loss to investors who have funded the loan. This can result from various factors, such as financial difficulties, job loss, or unexpected expenses.

Loanch helps protect investors against this default risk by having a buyback obligation on all loans. In this arrangement, if a loan payment is delayed by more than 30 days, the loan originator must repurchase the loan in full, along with any accrued interest.

This mechanism provides a safety net for investors, as the loan originator assumes responsibility for the defaulted loan, thereby mitigating the risk carried by investors.

The 30-day buyback guarantee is shorter than the normal 60-day buyback most platforms offer.

Loan originators risk

Loan originator risk refers to the potential risk of the loan originator being unable to fulfill its obligations to the investors. This risk arises from factors such as financial instability, operational errors or failures, potential insolvency or bankruptcy of the loan originator, inadequate underwriting policies, or any other issues that could hinder the performance of the loans.

Investors can protect themselves from loan originator risk when investing on platforms like Loanch by doing thorough research on the loan originators listed on the platform, focusing on their financial performance, underwriting policies, skin in the game, and historical default rates. This will help determine the risk associated with each loan originator.

Investors can also diversify their investments among loan originators. This helps to spread the risk and reduce the impact of an individual loan originator’s failure on the overall investment portfolio.

Loanch bankruptcy risk

The platform risk refers to the potential challenges and vulnerabilities that investors may face when using a P2P lending platform. These risks may include the platform’s financial stability, regulatory compliance, security measures, and overall management. If a P2P lending platform like Loanch goes bankrupt, it might create uncertainties for both investors and borrowers.

In case Loanch goes bankrupt, the platform should have a contingency plan in place to ensure the protection of investors’ funds and maintain loan contracts. This plan would typically involve a third party stepping in to manage the existing loans and return funds to investors when borrowers make repayments.

However, during the transition period, there might be delays in repayments or updates on the loan status. Investors should always be aware of the platform risk and diversify their investments across multiple platforms to minimize losses in case of bankruptcy.

Economic turndown risk

Economic turndown risk is the probability that an economic downturn or a decline in the financial circumstances of borrowers will affect the performance of investments. In the context of a P2P lending platform like Loanch, it refers to the likelihood that borrowers may default on their loans or the platform itself could struggle during periods such as recessions or market crashes.

This risk affects investors on P2P lending platforms primarily in two ways. First, when borrowers default on their loans, investors may lose all or part of their invested principal. This can lead to losses in their portfolios as well as reduced returns on their investments. Second, during economic downturns or periods of financial stress, the number of borrowers who qualify for loans may decrease, and the overall quality of borrowers may decline. This can result in reduced lending options for investors on the platform leading to potentially lower returns.

Investors should carefully consider the financial turndown risk when investing via a P2P lending platform like Loanch and perform their due diligence on the platform’s lending criteria, underwriting process, default rates, and past performance during economic downturns. Additionally, diversification across multiple loans, industries, and platforms can help mitigate the impact of this risk on an investor’s portfolio.

Is Loanch safe?

Loanch has put in place mechanisms to ensure a certain level of safety for investors. Among other things, they have implemented a buyback guarantee for all loans and have segregated accounts to protect investors’s funds from the potential bankruptcy of Loanch.

However, the platform cannot guarantee total safety or prevent potential losses. No investment is entirely risk-free, and Loanch, like other crowdlending platforms, still carries risks associated with borrower defaults, loan originators, and economic downturns.

As an investor, it is important to do your own research and due diligence before you invest, understand the risks involved, and consider diversifying your investment portfolio to spread the risks further. Remember that guarantees provided by the platform are not a substitute for portfolio diversification.

Our experience with Loanch

Based on our test of the Loanch P2P lending platform, we had a positive experience. The platform’s user-friendly interface and easy navigation make it stand out among other platforms. The sign-up and KYC process was simple and only took around 3 minutes using Veriff. Loanch also offers various features and tools, such as auto-invest that make investment straightforward.

In our opinion, Loanch is suitable for both beginners and more experienced investors. However, it’s essential to keep in mind the risks associated with P2P investing.

Loanch reviews on Trustpilot

Trustpilot is a great place to learn what other people think of P2P lending platforms. Currently, there are no Loanch reviews on Trustpilot.

Best Loanch alternatives

Not sure Loanch is the right choice for you? Then there are also some good Loanch alternatives to consider. The following are some of our favorites:

- PeerBerry (consumer lending platform)

- ReInvest24 (real estate crowdfunding platform)

- AxiaFunder (litigation crowdfunding platform)

- Debitum (P2B lending platform)

Even if you use Loanch, it might be a good idea to take a closer look at some of the above platforms. By using multiple platforms, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our Loanch review

Loanch is a promising P2P lending platform offering investors the opportunity to easily invest in consumer loans in high-growth Southeast Asian markets with attractive returns.

The 30-day buyback guarantee sets it apart from competitors due to the shorter buyback period, which can be attractive for investors. The platform also has an auto-invest option which works just like it should.

Loanch could be more transparent with financial reports on its website and it would be great if there were more loan originators to choose from.

Loanch’s focus on short-term loans reduces the necessity for a secondary market. An early exit option would be a welcome addition for investors seeking more flexibility.

Overall, Loanch presents a compelling choice for P2P investors looking to diversify their portfolios in emerging markets.