Interview with Lonvest’s CEO Roman Katerynchyk

We are excited to bring you an exclusive interview with Roman Katerynchyk, the CEO of Lonvest. This interview took place in October 2023 and promises to shed light not only on Lonvest’s unique operations but also on Roman’s personal viewpoints and insights into the P2P lending industry.

Without further ado, let’s delve into the interview we had with Lonvest’s CEO.

Haven’t heard of Lonvest before? Learn our opinion about Lonvest here.

What is Lonvest in a few words?

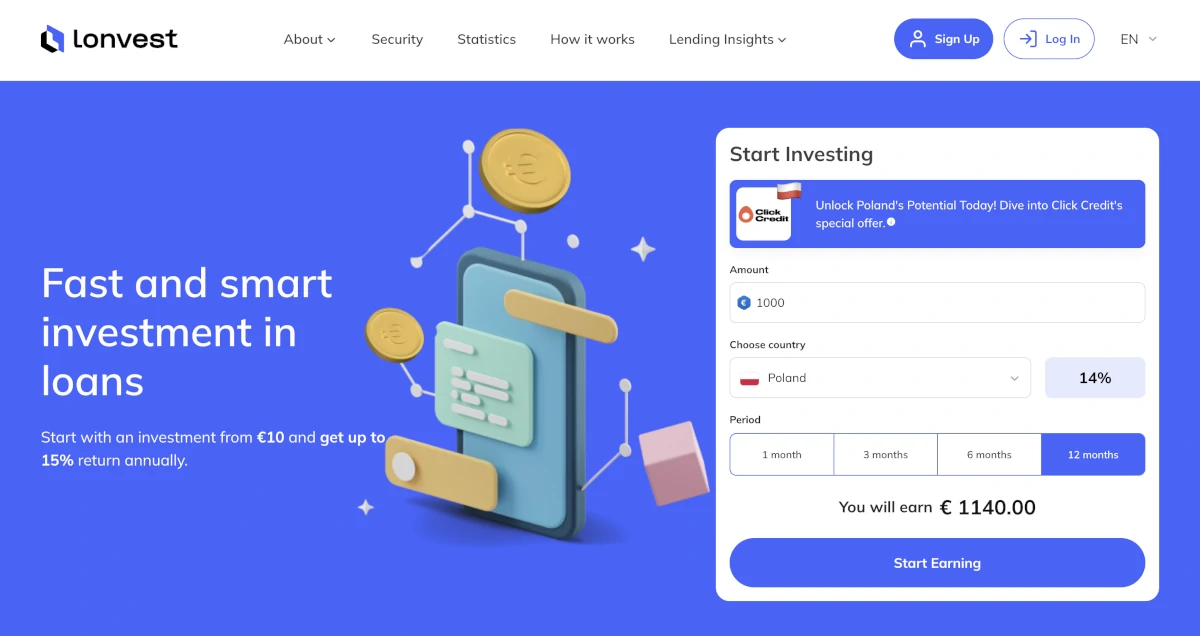

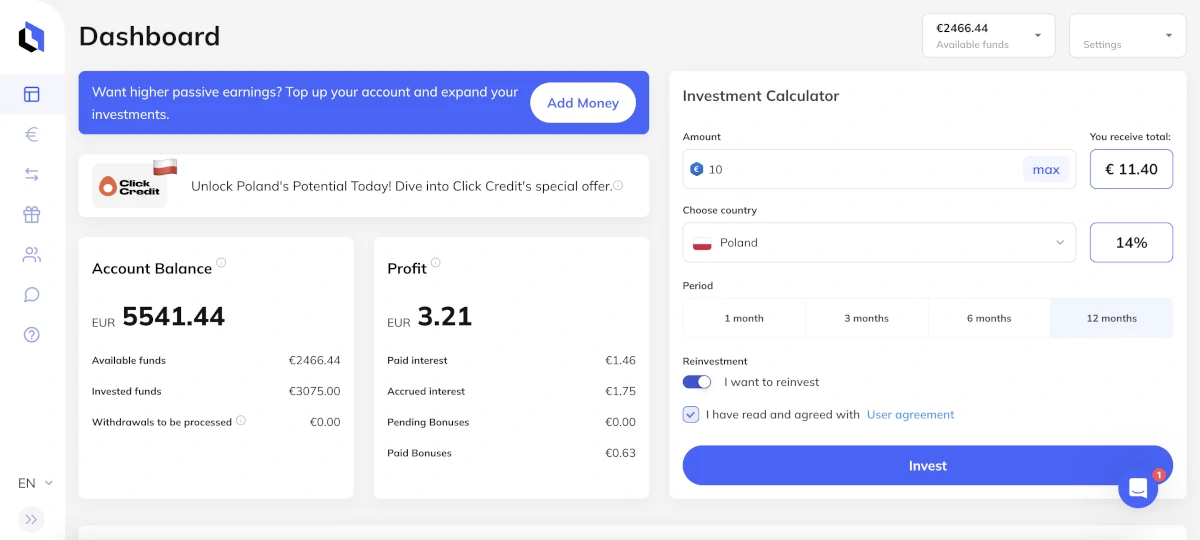

In essence, Lonvest is a P2P lending platform designed to offer individuals a pathway to achieve passive income by investing in loans. What truly sets us apart is our promise of transparency, responsibility, and unmatched reliability, with potential annual returns soaring up to 15%.

My journey in the fintech world began over 16 years ago. I’ve been privileged to carve out successes across diverse geographies like the EU (Ukraine, Poland), and SEA regions, including Vietnam and Sri Lanka. Through this journey, we’ve introduced innovative products to more than 5 million users worldwide. This extensive experience, especially in fintech over the past decade, serves as the foundation for Lonvest.

All the investment opportunities we present are exclusive, a result of our group’s relentless efforts. With over seven fruitful years in various markets, our associated companies have established themselves as leaders, particularly in the realm of short-term loans and installments.

If I were to distill what makes Lonvest unique into three core pillars, it would be:

- State-of-the-Art Technology: We’re not just a platform; we’re a tech-driven experience. With features like auto-invest and a user-centric design, we’re making the investment journey not just fruitful, but also delightful.

- A Team of Mavericks: We’re backed by a robust team, each member seasoned with over a decade’s experience in areas like loans, investment, and risk management.

- Trust and Security First: In the volatile world of investments, we understand the value of trust. That’s why it’s not just a word for us; it’s a commitment embedded in our operations.

So, to sum it up, Lonvest is more than just a platform — it’s a culmination of years of expertise, a commitment to innovation, and an unwavering dedication to our users.

Is Lonvest a regulated platform?

It’s crucial for our users and partners to understand the regulatory environment we operate in. In Croatia, where we operate as an intermediary between Claim Purchasers and Claim Sellers, there’s no licensing requirement. This has been confirmed not only by our external advisors but is also evidenced by industry stalwarts like Peerberry and Robocash, both of whom provide similar services in Croatia without necessitating a license.

It’s worth noting that we’ve been proactive in ensuring our legal stance. We possess comprehensive legal opinions and have also received comments from the regulatory authorities, all of which reaffirm our position.

Our journey with regulations has always been about maintaining transparency and upholding the highest standards of integrity. As for the future, while the current regulatory framework supports our operations, we’re always vigilant and ready to adapt, ensuring we remain compliant and safeguard our stakeholders’ interests.

What safety measures does Lonvest have to protect investors?

Safety and transparency stand at the forefront of our operations at Lonvest. Here’s how we ensure our investors are well-protected:

- In-depth Oversight of Loan Originators: Every company on our platform operates under our watchful eye, delivering daily management accounting reports. This granular, daily insight ensures they consistently uphold our rigorous standards.

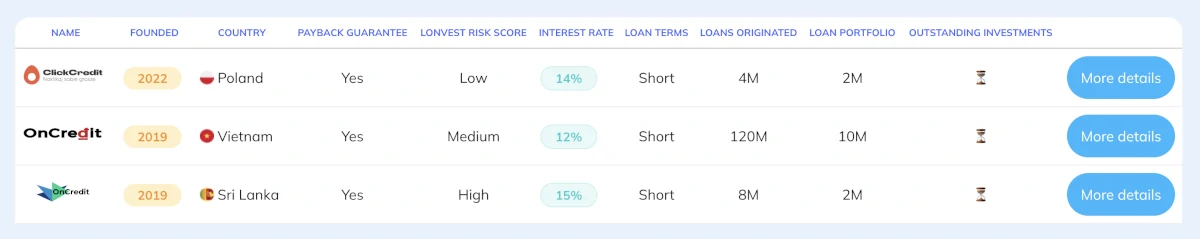

- Buyback Guarantee: We understand that investments can be unpredictable. That’s why we offer a built-in safety net: if a loan repayment is delayed by more than 60 days, the loan originator will buy it back on the 61st day, ensuring you still earn the interest for both the loan term and buyback period.

- Group Guarantee: Taking protection a notch higher, we have a group guarantee in place. If unforeseen challenges arise at the company level, other entities within our group rally to ensure depositors aren’t left in the lurch.

Compared to other platforms, our emphasis on both direct oversight and a multi-tiered guarantee system sets us apart. However, as with all investments, there are inherent risks. While our protective measures significantly reduce these risks, they cannot eliminate them. Our goal, however, is to constantly mitigate them to the greatest extent possible.

And as for buyback, it’s an integral part of our commitment to investor protection, ensuring that they have a safeguard in case of borrower delinquencies.

In sum, at Lonvest, we’ve designed a safety framework that not only shields our investors but also instills confidence in their investment journey with us.

What makes Lonvest stand out from the competition?

At Lonvest, our distinctiveness is carved out of a blend of experience, innovation, and our commitment to stakeholders. Here’s how we differentiate ourselves:

- Proven Expertise: With over 13 years of experience in the fintech industry, our group of companies has a solid track record of success. We have honed our skills in building effective lending businesses, ensuring that your investments are in capable hands.

- Cutting-edge Technology: Our loan originators use a special borrower scoring system that leverages advanced artificial intelligence technologies. This allows us to assess risks accurately and make informed decisions on loan issuance. By utilizing innovative technology, we increase the chances of investing in borrowers who will repay their loans, maximizing the returns on your investments.

- Profitable Loan Originators: We collaborate with loan originator businesses that have a demonstrated history of profitability. This ensures that your investments are directed toward ventures that have a proven track record of generating returns.

- Easy and Convenient: Our platform is designed to provide a seamless investment experience. With just a click, you can start generating an annual passive income ranging from 12 to 15%. We prioritize simplicity and convenience, allowing you to focus on growing your wealth effortlessly.

- Buyback Guarantee: We offer a buyback guarantee, providing you with peace of mind and a convenient exit strategy. If you decide to withdraw your investment, we guarantee to repurchase your deposit, safeguarding your capital and providing you with flexibility.

In essence, while many platforms might offer lending and investment opportunities, at Lonvest, we deliver these with a blend of seasoned expertise, technological prowess, strategic collaborations, and an unwavering commitment to both borrowers and investors.

What types of loans do you work with?

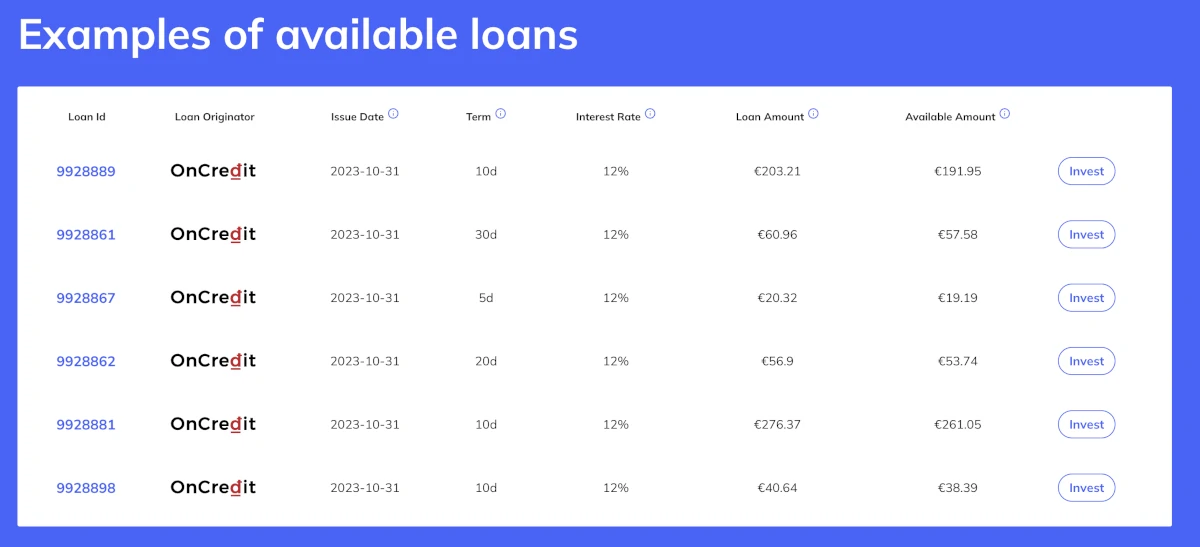

At Lonvest, we primarily deal with short-term loans. These are designed for borrowers who require immediate financial assistance and can repay within a relatively shorter time frame.

Here is an interview with Timur Bugaevskiy the Head of Data Science Lab, a division of Space Crew Finance. In this interview, we explored how our loan originator partners meticulously select suitable loan recipients, the innovative technologies they employ, and the reasons why investing in the loan business, even in developing countries, can be highly lucrative.

This is what the process looks like:

- In-depth Analysis: Every loan application undergoes a comprehensive assessment. Our partners evaluate the borrower’s financial history, credit score, and current financial standing.

- Advanced AI-driven Scoring: Building on LO’s technological foundation, they employ cutting-edge AI tools to accurately gauge the risk associated with each loan application. This system analyzes myriad data points to predict the likelihood of timely repayment.

- Affordability Check: It’s essential to ensure that the borrower can comfortably repay the loan without undue financial strain. LO assesses their monthly income, expenses, and any existing financial commitments.

- Verification & Validation: Our partners also carry out meticulous verification of the provided documents, ensuring authenticity and accuracy.

- Final Review: Post all the evaluations, a final review is conducted by an expert team, considering all the collated data and analytics.

Only after passing through this stringent process, a loan is approved and made available for investors on our platform. This meticulous approach ensures we maintain the integrity of our platform and protect the interests of our investors.

Which countries are Lonvest’s projects based in?

We’re actively engaged across a range of dynamic markets: Vietnam, Poland, and Sri Lanka, each with its unique attributes and opportunities.

- OnCredit, Vietnam: As a predominant loan originator in Vietnam since 2019, OnCredit has carved a niche for itself. With a robust product, a team of 120 professionals, and 2 million clients under their belt, they now command a loan portfolio worth 10 million dollars.

- ClickCredit, Poland: partners’ recent launch in Poland has already shown remarkable progress. Their newly introduced card product epitomizes their dedication to innovation. The exponential growth they’ve witnessed in this market underscores its potential and the exciting journey ahead for our investors.

- OnCredit, Sri Lanka: With a client base of 220,000 and a monthly issuance of 18,000 loans, OnCredit showcases resilience and efficiency. Managing a team of over 70 during turbulent times and maintaining a loan portfolio of 2 million dollars is a testament to their mettle.

- MyCredit, Ukraine: Though not currently active due to prevailing circumstances, MyCredit Ukraine holds a strong foothold in its native market. We’re closely monitoring the situation and look forward to reintroducing Ukrainian loan originators post-conflict, broadening the spectrum for our investors.

In essence, our presence in these diverse nations not only offers an array of investment opportunities but also reflects our commitment to tapping into high-growth potential markets for our investors.

What are your impressions of your current markets?

We’re actively engaged across a diverse landscape of markets, each distinct in its maturity and current dynamics.

Consider Poland, for instance. It stands as a seasoned market with a well-established regulatory framework and customer service standards. Such clarity allows for precise developmental planning, from product evolution to nurturing customer relations. A noticeable trend here is the evolving symbiotic relationship: while companies are enhancing customer conditions, borrowers are reciprocating with improved loan servicing, leading to a healthier overall portfolio.

In contrast, markets like Vietnam and Sri Lanka in Asia are buzzing with energy and potential. As their economies surge, so does internet penetration, expanding our product’s accessibility. Vietnam, despite some recent regulatory hiccups, is witnessing increased collaboration between its national bank and financial entities, paving the way for progressive market regulation.

Zooming out to view the broader Southeast Asian landscape, the potential is palpable. We foresee the market ballooning multiple times in the coming 3-5 years. Indeed, we’re bracing ourselves for an exhilarating growth trajectory.

What are your predictions for the future of the P2P lending industry?

Great question! When I look at the trajectory of P2P lending, a few thoughts come to mind:

On the Future:

- Going Mainstream: I genuinely believe we’re on the cusp of seeing P2P lending moving from the sidelines right into the mainstream. It won’t just be an ‘alternative’ anymore.

- Tech’s Role: We’re going to lean more heavily into tech. Think AI for smarter risk assessment, or even blockchain for security. The integration of such technologies will refine and revolutionize the experience for both lenders and borrowers.

- More than Just Loans: P2P platforms won’t just stop at loans. There’s so much potential. Maybe we’ll see them stepping into spaces like insurance or even wealth management. The sky’s the limit!

Developments on the Horizon:

- Unified Rules: One big shift I see, especially in the EU, is a more unified approach to regulations. It’s going to make things smoother for platforms like ours and give our users more peace of mind.

- Green Lending: With the world moving towards sustainability, ‘green loans’ supporting eco-initiatives might become a big thing. It’s about time finance played its part in saving the planet, right?

- Strategic Alliances: Don’t be surprised if you see P2P platforms shaking hands with some big tech names or even traditional banks. These partnerships can be game-changers.

Improving the Industry:

- Education is Key: We’ve got to be transparent and educate our users. The more they know, the more trust we build.

- Safety First: We have to keep pushing the boundaries of risk management. Our investors’ trust hinges on how safe their money is with us.

- Broadening Our Reach: P2P lending is about financial inclusivity. We need to do better in reaching those who’ve been left out of the traditional financial system.

All in all, I’m bullish about P2P lending’s future. It’s a dynamic space, and at Lonvest, we’re all geared up and excited for what’s coming next!

What do you think is the biggest risk for P2P investors right now?

That’s a pressing question, and it’s something we think about constantly. When I look at the P2P landscape, the risks can generally be bucketed into a few categories:

- Macroeconomic Factors: Absolutely, the broader economic climate plays a role. Recessions, inflation rates, and shifts in interest rates can all influence borrower defaults and returns on investments. We’re in a volatile global economy, and these are real concerns.

- Regulatory Landscape: Rapid changes or uncertainties in regulatory frameworks can pose challenges. It’s all about adapting and staying compliant.

But here’s the thing: recognizing these challenges is just the first step. At Lonvest, we’re all about proactive solutions.

Addressing the Risks:

- Diversification: We always advise our investors to diversify their investments. Spreading out investments reduces exposure to any single economic event or borrower default.

- Transparency: By being transparent about our operations and financial health, we ensure our investors are well-informed. Knowledge breeds confidence.

- Cutting-edge Tech: We employ advanced tech solutions for better risk assessments. This helps in identifying potential high-risk borrowers, minimizing the chances of defaults.

- Staying Agile: With the ever-evolving regulatory landscape, we ensure we’re always compliant. It’s about being nimble, adapting quickly, and ensuring we’re on the right side of the law.

In essence, while risks are inherent in any investment landscape, our approach at Lonvest is to stay ahead of the curve, be transparent, and keep innovating. We’re here for the long haul, and our priority is, and always will be, our investors’ trust and safety.

Do you have any news regarding your platform?

Yes, we’ve introduced a Referral Program for our existing clients. Essentially, when a current client refers a new user to Lonvest, both parties benefit. It’s a straightforward way to encourage organic growth through word-of-mouth. We believe in the quality of our platform, and this program allows our clients to share their experience and benefit from it. Additionally, we’re working on several other platform updates that we’ll be rolling out in the near future.

We’re deeply committed to disseminating our expertise in the digital lending arena. Not only do we regularly publish useful articles, but we also spotlight the wisdom of C-level loan originators we collaborate with through exclusive interviews. Beyond that, our multimedia efforts extend to crafting engaging videos and comprehensive e-books, ensuring a well-rounded knowledge-sharing experience.

What do you have in the pipeline for your investors?

Our focus is always on delivering more value to our investors. Here’s a snapshot of our immediate plans:

- Loyalty Rewards: Recognizing the trust our investors place in us, we’re introducing a Loyalty Rewards program. This is our way of showing appreciation to those who have been with us over time, ensuring they see tangible benefits from their continued commitment.

- Corporate Profiles: We’re expanding our investor base. Soon, we’ll be accommodating businesses, not just individuals. This move will allow companies to diversify their investment portfolios and benefit from the potential returns our platform offers. It’s crucial for us to keep evolving and innovating. At Lonvest, we’re committed to ensuring our investors always get the best, and we have several initiatives lined up to ensure just that.

Why should investors choose Lonvest?

Our team, with extensive experience in fintech, has tailored Lonvest to address specific gaps in the P2P market. We provide an unparalleled blend of transparency, efficiency, and risk management, ensuring investments are both secure and lucrative.

As the industry evolves, so do we. We’re continuously innovating and adapting to ensure our investors get the best returns. Our proactive approach and commitment to growth mean that investing with Lonvest today has significant potential for tomorrow.

To make things even more enticing for new investors, we’re offering a special 1% cashback bonus for those who sign up through specific referral links, such as the one at the bottom of this interview. It’s our way of welcoming you to the Lonvest family.

In essence, Lonvest is not just another P2P platform. It’s a meticulously crafted investment avenue, designed with the investor in mind. If you’re looking for a platform that marries security with growth prospects and offers tangible benefits like the cashback bonus, Lonvest is the choice.