Nibble Finance review 2024

Is Nibble Finance a great platform for P2P lending? Find out in our Nibble Finance review below:

Nibble Finance

Pros:

Cons:

Review summary:

Nibble Finance is a well-established P2P lending platform from 2020 focusing on consumer loans. The platform is easy to use with its predefined auto-invest strategies and simple interface. Investors considering the platform should be aware that the platform only has loans from the IT Smart Finance group, which means that the platform in itself is not ideal for diversification. With that said, IT Smart Finance is profitable and you can invest in loans with a buyback guarantee using the platform’s Classic Strategy. The few investors that have reviewed Nibble Finance on Trustpilot are positive about it.

It’s free to use the platform.

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Introduction to our Nibble Finance review

Are you considering investing via Nibble Finance? Then read on. We’ve written this nibble.finance review to help investors determine if Nibble Finance is the right choice for them.

Below you will find an overview of the things that we will discuss more in detail in this Nibble review. Simply click the links to jump directly to what you want to know more about.

Learn about this in our Nibble Finance review:

- What is Nibble Finance?

- Key features

- Who can use Nibble Finance?

- How safe is Nibble Finance?

- Nibble Finance reviews on Trustpilot

- Best Nibble Finance alternatives

- Conclusion of our Nibble Finance review

What is Nibble Finance?

Nibble Finance is a P2P lending platform owned by the financial conglomerate IT Smart Finance. The company behind Nibble Finance is from Tallinn, Estonia but is operated from Barcelona, Spain.

On the crowdfunding platform, you can invest in consumer loans that originate from Joymoney – a brand also owned by IT Smart Finance.

Joymoney is currently active in Russia and Spain, which means that these are the geographic areas where the loans on the platform are from.

Nibble Finance launched in 2020, which means that the platform is still a startup. But still, the little over 8,504 investors on the crowdlending platform are currently earning an average return of around 12.00%.

With as little as €10, you can start investing on the platform at https://nibble.finance/.

Nibble Finance statistics:

| Founded: | 2020 |

| Loan Type: | Consumer |

| Loan Period: | 1 – 60 Months |

| Loans Funded: | € 2,055,000 + |

| Nibble Users: | 8,504 + |

| Minimum Investment: | € 10 |

| Maximum Investment: | Unlimited |

| Nibble Interest Rate: | 12.00% |

How Nibble Finance works:

The whole process starts when a consumer takes a loan via one of the loan originators in either Spain or Russia. Here the customers’ financial situation and creditworthiness are determined. If the borrower is suitable for credit, a loan is issued by Joymoney.

To gain more liquidity to issue more loans, Joymoney then turns to Nibble Finance where investors can invest in shares of the loans at a lower interest rate than what Joymoney received.

When investors invest in the loans Joymoney can now issue more loans and expand the business further.

This creates a win-win situation between investors and the loan company.

Frequently asked questions:

Key features

In the following, we take a closer look at some of the key features that make it easy to invest your capital via Nibble Finance:

1. Nibble Finance auto-invest strategies

One of the things that make Nibble Finance easy to start investing with is its auto-invest strategies. Using one of these predefined strategies, you can invest in P2P loans that fit within your chosen strategy and earn passive income.

To get started with Nibble Finance auto-invest strategies, follow this process:

- Log in at https://nibble.finance/

- Add funds to your account

- Choose your auto-invest strategy

Once you have signed up and gone through the verification process, it only takes a few moments to set up the auto-invest functionality on your account.

You can choose between the following 3 strategies:

- Classic Strategy (used by 22% of investors)

- Balanced Strategy (used by 65% of investors)

- Legal Strategy (used by 13% of investors)

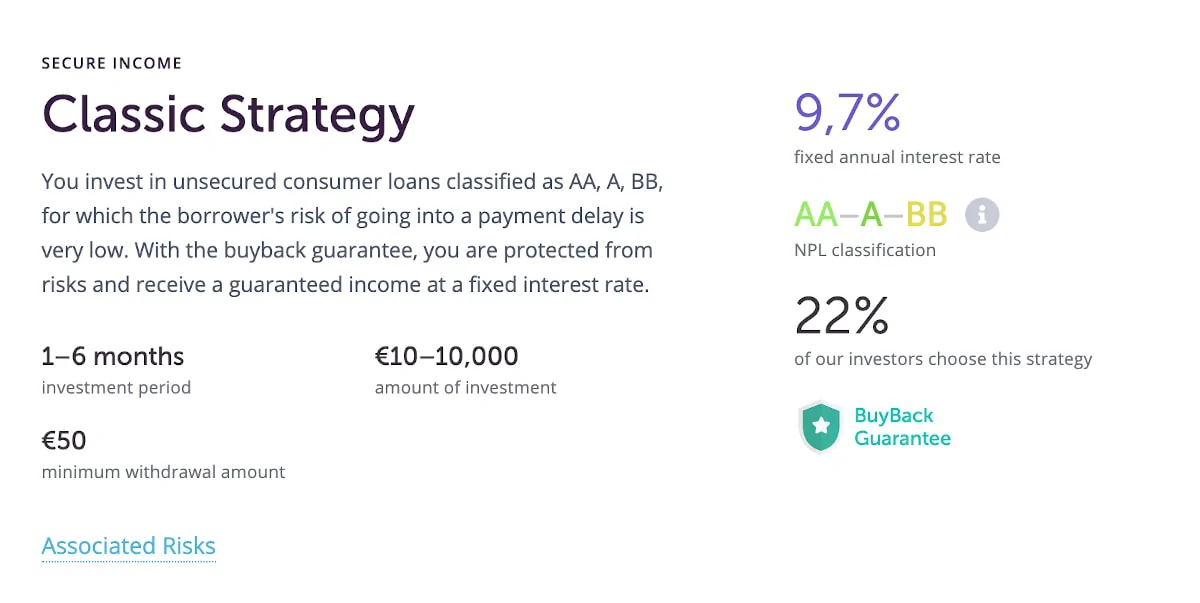

Classic Strategy:

The Classic Strategy is for investors looking for the most secure Nibble investment option. Here you are investing in some of the safest loans on the platform. The loans in this strategy are also covered by the Nibble Finance buyback guarantee.

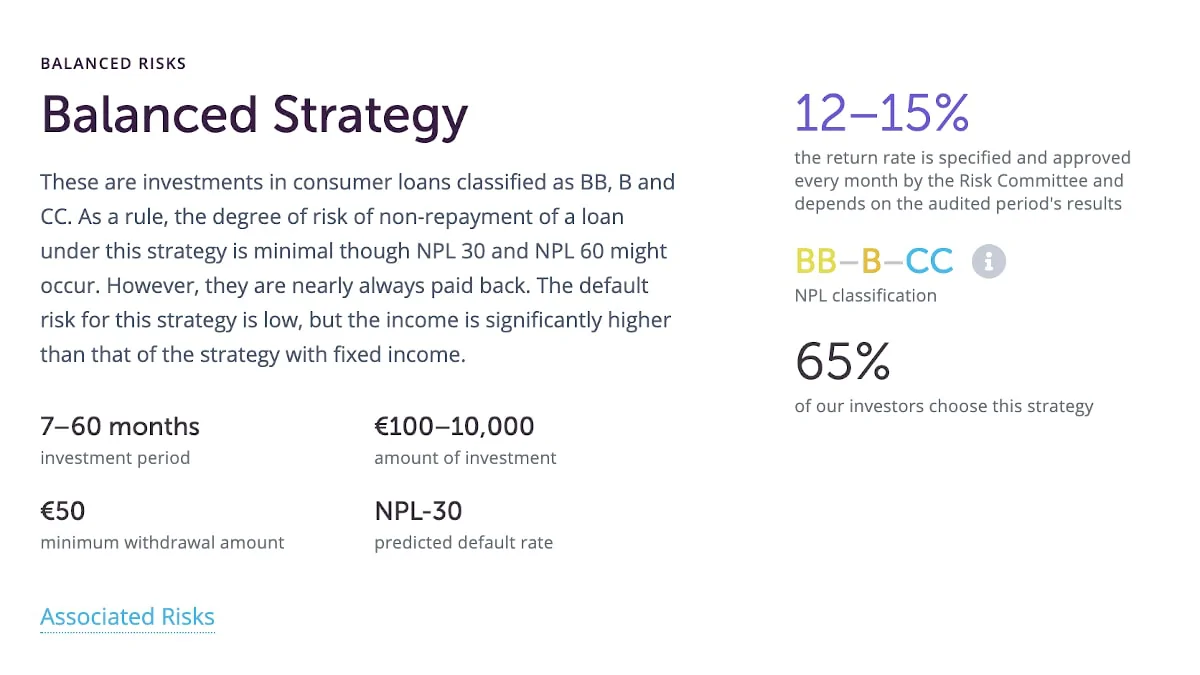

Balanced Strategy:

The most popular strategy on the platform is the Balanced Strategy. This investment strategy involves a bit more risk than the Classic Strategy as the loans are not as safe.

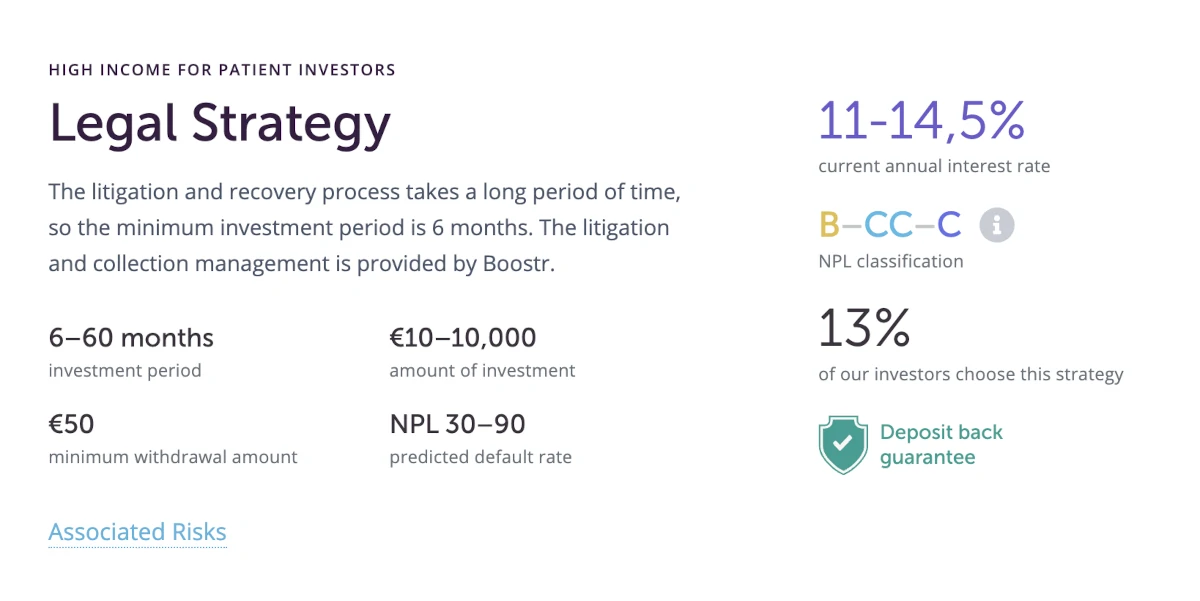

Legal Strategy:

If you are looking for a high return rate and can tolerate a bit more risk, the Legal Strategy is also an option to consider. With this investment strategy, you are getting the riskiest P2P loans on the platform.

The Legal Strategy is a unique investment product offered by the Nibble P2P lending platform since 2023 that focuses on investing in portfolios of overdue consumer loans (classified as B, CC, and C). These loans are currently in the pre-trial and judicial recovery process, which provides the opportunity for increased yields.

The main attraction of this strategy is the potential for high yields, reaching up to 14.5% per annum, due to the overdue debts, fines, and risks associated with the loans.

The debt recovery process is managed by Boostr, a company with over five years of experience in debt collection. They purchase overdue loans from banks and MFOs at an 85% discount and automate the extrajudicial and legal recovery process.

If the borrower does not agree to repay the debt out of court, Boostr initiates an automated process of recovering the debt through legal proceedings. This involves obtaining a court decision on debt collection from the debtor, followed by the collection of debt, interest, and fines through bailiff services and banks.

Potential investors need to understand the risks associated with investing in overdue loans, as the recovery process can be lengthy and uncertain. Before investing in the Legal Strategy, you should also consider if the illiquid nature of this product suits you as there is a minimum investment period of 6 to 12 months.

The Legal Strategy comes with a Deposit back guarantee, which ensures a minimum yield of 8% per annum. As with any other guarantees in P2P investing, you should be aware that there can be situations where the guarantee can’t be fulfilled.

2. Nibble Finance buyback guarantee

The loans in the Classic Strategy on Nibble Finance come with a 60-day buyback guarantee.

This is the lender’s obligation to buy back the loan from the investor if the loan is not repaid or has been extended for more than 60 days.

As an investor, you should keep in mind that the buyback guarantee is only as solid as the solvency of the company issuing the guarantee. This means that even though a loan has a buyback guarantee, it doesn’t mean that your money is 100% safe.

3. Early exit

Nibble Finance doesn’t have a secondary market but allows investors to terminate the investment agreement early. If the investor decides to terminate the agreement, the platform will start looking for another investor to take over the portfolio.

If a new investor isn’t found within 60 days, Nibble Finance pays out the number of funds invested as well as accrued interest on day 61. Nibble Finance charges a 3% commission for this.

You also keep in mind that the withdrawal time is 5 days and the minimum withdrawal amount is €50.

Who can use Nibble Finance?

Both individuals and companies can invest via the Nibble P2P lending platform.

Individuals

If you want to invest as an individual, you must at least meet the following requirements:

- Being at least 18 years old

- Provide a copy of your identification documents

- Have a bank account in the European Economic Area (EU, Switzerland, Norway, and Liechtenstein)

- Be a resident or have citizenship in the European Economic Area

If you live up to these requirements, then you can start investing on the platform at https://nibble.finance/.

If you don’t have a bank account in Europe, Nibble Finance might still accept you as an investor, but this will require an additional personal AML check. Each case will be considered individually.

Companies

Companies can also invest via Nibble Finance. To do so, they must sign up as a legal entity in the sign-up process.

How safe is Nibble Finance?

To determine if Nibble Finance is safe, we have taken a look at some of the potential upsides and downsides of investing with Nibble Finance.

1. Nibble Finance profitability

Nibble Finance is owned by IT Smart Finance, which has been profitable for multiple years. You can find the annual reports from IT Smart Finance here.

2. Main risks

In the following, we go through some of the main risks of using Nibble Finance that we have considered:

Loan default risk

When you invest in P2P loans, there is a risk that the borrower will not be able to repay his loan. In that case, your investment is usually lost.

However, some of the loans at Nibble Finance have a buyback guarantee that can secure you against this type of event.

Nibble Finance bankruptcy risk

The company behind the platform itself also poses a risk for investors. If IT Smart Finance, the company that owns Nibble Finance, goes bankrupt, you can potentially struggle with getting out of the investments and getting your money back.

But as IT Smart Finance is a profitable company, bankruptcy doesn’t seem very likely at the moment.

Financial turndown risk

As P2P investing is a newer thing in the investment world, it can be difficult to predict how a financial turndown would affect this form of investment. As a starting point, it is, therefore, a really bad idea to invest your entire investment portfolio in P2P investments.

Therefore, many investors also choose to diversify into more traditional forms of investment such as equities, bonds, and traditional real estate.

Since investing is an individual thing, we do not know what will be best for you. But if you put together your investment portfolio, make sure that it reflects your knowledge of the investments in it, as well as your risk appetite. If in doubt about how to do so, seek help from a professional investment planner.

Is Nibble Finance safe?

Despite being a new European startup, Nibble Finance is owned by a fairly stable financial conglomerate, which makes Nibble Finance seem quite safe.

Other factors such as lack of knowledge about how a financial turndown will affect the P2P lending industry are also risk factors that are worth considering.

Nibble Finance reviews on Trustpilot

Trustpilot is a great place to learn what other people think of Nibble Finance. We have collected some relevant Nibble Finance reviews from Trustpilot for you to take a closer look at:

Best Nibble Finance alternatives

Not sure Nibble Finance is the right choice for you? Then there are also some good Nibble Finance alternatives to consider. The following are some of our favorites:

- Robocash (similar platform)

- PeerBerry (popular platform)

- Mintos (biggest platform)

- ReInvest24 (real estate focus)

- EstateGuru (real estate loans)

Even if you use Nibble Finance, it might actually be a good idea to take a closer look at some of the above platforms. By using multiple platforms, you can reduce your platform risk and diversify your portfolio further.

Conclusion of our Nibble Finance review

Nibble Finance is a promising new P2P lending platform where investors can invest in Spanish and Russian loans from Joymoney. The platform is a product of IT Smart Finance, which is a profitable Spanish finance company.

On Trustpilot, you will only be able to find positive reviews about Nibble Finance. But you should keep in mind that the platform is still very new, which means that it still hasn’t had many investors review it yet.

The platform has some easy-to-use strategies that make it very uncomplicated to invest via the platform.

The main downside of Nibble Finance is the fact that the platform is very new and only has loans from IT Smart Finance companies.