VIAINVEST Review 2024: How Safe is VIAINVEST?

Viainvest stands as one of the more established platforms, offering investors an opportunity to earn up to 12% annual returns by investing in consumer loans across Europe. Founded in 2016 and headquartered in Latvia, VIAINVEST has carved out a niche by providing access to loans from countries like Latvia, Sweden, and the Czech Republic. This VIAINVEST review aims to provide an in-depth analysis of VIAINVEST, evaluating its features, performance, and how it compares to other platforms in the P2P lending space.

VIAINVEST rating

VIAINVEST review summary:

VIAINVEST is a good P2P lending platform for investing in consumer loans. The platform is fairly safe with a buyback guarantee on loans. In comparison to other platforms, the return on VIAINVEST is also acceptable. Investors should be aware that the platform’s percentage of non-performing loans is quite high, which is a risk even though the platform has a buyback guarantee.

What is VIAINVEST?

VIAINVEST is a P2P lending platform operated by VIA SMS Group, a financial services company established in 2009. As a regulated investment firm, VIAINVEST offers investments in asset-backed securities (ABS), primarily unsecured consumer loans. Investors can start with as little as €50 and leverage features like auto-invest to streamline their investment process.

VIAINVEST was launched in 2016 and has since enabled investors to invest in loans from VIA SMS Group and its subsidiaries. Investors can invest in both consumer loans and business loans with a 60-day buyback obligation.

The average annual return on VIAINVEST is around 12.00% and the platform is quite popular with more than 35,000 investors.

With as little as €50, you can open an account and start investing at https://viainvest.com/.

VIAINVEST statistics:

| Founded: | 2016 |

| Loan Type: | Consumer |

| Loan Period: | 1 – 24 Months |

| Loans Funded: | € 374,084,889 + |

| VIAINVEST Users: | 35,893 + |

| Minimum Investment: | € 50 |

| Maximum Investment: | Unlimited |

| VIAINVEST Interest Rate: | 12.00% |

How VIAINVEST works

The VIAINVEST marketplace connects private European investors with various loan originators that have already issued loans.

Using the platform, investors can invest in asset-backed securities (ABS) issued by subsidiaries of the VIA SMS Group.

Loan originators benefit from increased liquidity when VIAINVEST users invest in loans on the marketplace. This allows lending organizations to make more loans and expand their operations. In return, investors earn a yield on their investments.

Pros & Cons

Here is an overview of the pros and cons of using VIAINVEST:

Pros:

- High availability of loans: Consistent supply of investment opportunities in consumer loans.

- Attractive interest rates: Offers competitive returns of up to 12% annually.

- Regulated: VIAINVEST holds an Investment Brokerage Firm (IBF) license, adding a layer of regulatory oversight.

Cons:

- Transparency issues: Does not disclose critical loan performance data.

- Questionable business practices: There have been past instances where the platform modified investment terms without investor consent.

- Limited liquidity: No secondary market to sell investments before maturity.

- Tax implications: Investors may face a 20% tax withholding on earnings, with additional paperwork to reduce it.

Key features

Here is an overview of the main features on VIAINVEST:

1. VIAINVEST buyback guarantee

VIAINVEST offers a 60-day BuyBack obligation for most loans.

If the borrower fails to make payments on time for 60 days or defaults on the loan, the lending business is required to buy back the loan from the investor with full principal and interest.

The buyback guarantee is a promise from the loan originator, not backed by an external insurance or financial authority. This means that the buyback guarantee is only valid as long as the issuer of the guarantee can keep the promise.

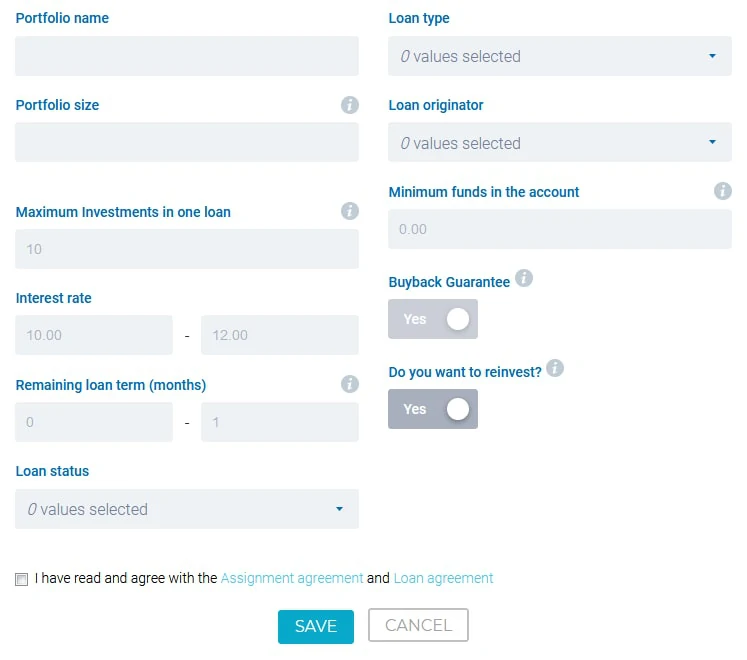

2. VIAINVEST auto-invest

VIAINVEST offers an auto-invest tool that makes it possible for investors to automate their investments on the platform.

To use the VIAINVEST auto-invest tool, do the following:

- Sign up at https://viainvest.com/

- Log in to your account

- Select auto-invest

- Decide how you want to invest

The benefit of using the auto-invest tool is that you get full control of which investments you get, nearly as if you were manually selecting.

Who can use VIAINVEST?

VIAINVEST is suitable for individuals who meet the following criteria:

- You must be at least 18 years old.

- You should be a tax resident within the European Union (EU) or Switzerland.

The minimum investment on VIAINVEST is €50, which is higher than on similar platforms like Swaper and Robocash, where the minimum investment is €10.

Available countries

VIAINVEST is available to investors who live in the European Economic Area (European Union, Iceland, Liechtenstein, and Norway).

If you are looking for a similar platform that is available outside of Europe, you should check out Lendermarket or Bondster.

How safe is VIAINVEST?

VIAINVEST presents a mixed bag when it comes to safety. On one hand, its status as a regulated entity under MiFID II, participation in the Investor Compensation Scheme, and backing by an established parent company provide substantial safety assurances.

On the other hand, concerns about operational transparency, past business practices affecting investor interests, and liquidity constraints introduce elements of risk that potential investors must weigh carefully.

Company background

VIAINVEST is part of the VIA SMS Group, a profitable lending company operating since 2009. The group's long-standing presence in the financial sector and diversification across various European markets add a layer of stability. The parent company's financial backing can be a reassuring factor for investors concerned about the platform's longevity.

Regulation

VIAINVEST is regulated under the MiFID II framework and supervised by the Latvian Financial and Capital Market Commission (FCMC). Uninvested funds are held in segregated accounts, offering some protection in case of platform insolvency.

Being a regulated entity means that VIAINVEST participates in the Latvian Investor Compensation Scheme. In the unlikely event of the company's insolvency or misappropriation of funds, investors are protected up to €20,000. This compensation scheme enhances investor confidence, knowing there's a safety net in place.

Transparency

Viainvest provides audited financial statements and is transparent about its operations and financial health. However, the platform could improve by offering more detailed loan book performance data and real-time statistics. VIAINVEST does not provide detailed information on loan book performance or borrower default rates. Regular updates and open communication are crucial, especially when changes directly impact investors.

Asset-Backed Securities (ABS)

VIAINVEST offers investments in asset-backed securities rather than direct loan assignments. ABS are financial instruments backed by a pool of loans with similar characteristics. While this structure doesn't eliminate risk, it can help in spreading it across multiple loans, potentially reducing the impact of individual loan defaults.

Buyback guarantee

VIAINVEST provides a buyback guarantee on its loans. If a borrower delays payment beyond 60 days, the loan originator is obligated to repurchase the loan, returning the principal and accrued interest to the investor. While this feature adds a layer of security, it's important to note that the efficacy of the buyback guarantee relies on the financial health of the loan originators.

The 60-day buyback guarantee on VIAINVEST is comparable to most other P2P lending platforms. If you prefer a shorter buyback period, you might consider Robocash, which offers a 30-day buyback period.

VIAINVEST user experience

The user experience on VIAINVEST is generally positive in terms of functionality and basic investing operations. The platform suits investors who prefer a straightforward interface and the convenience of automated investing through the auto-invest feature.

The interface on VIAINVEST's platform is less intuitive and outdated compared to competitors like Debitum and PeerBerry. An outdated design and limited features may affect your overall experience. While not directly impacting safety, a user-friendly interface can help in efficiently managing investments and quickly addressing any concerns.

No secondary market

VIAINVEST does not offer a secondary market, meaning your funds are tied to your investments until they mature. This can be a disadvantage if you need access to your funds before then. If you prefer a P2P lending platform with a secondary market, you might consider alternatives like Mintos and TWINO.

Tax considerations

As a regulated entity, VIAINVEST is required to withhold a 20% tax on investor earnings. This rate can be reduced based on your country's tax treaty with Latvia and by submitting a valid tax residency certificate. Make sure to factor this into your net return calculations and consult a tax professional for personalized advice.

VIAINVEST reviews on Trustpilot

VIAINVEST has received 3.1 out of 5 stars on Trustpilot based on 39 reviews.

Some users praise VIAINVEST for being a reliable and sound P2P investment platform with good returns, especially when compared to alternatives. They appreciate the platform’s simplicity, the auto-invest option, and the quick and easy process of depositing and withdrawing funds for EU members.

Multiple users have experienced problems with identity verification, which has prevented them from withdrawing funds, and they express dissatisfaction with the support team’s response times. There are criticisms regarding the extension of loan terms and issues with account management features like generating statements. Some reviews highlighted problems with their referral program, where users didn’t receive promised bonuses due to technical issues.

Best VIAINVEST alternatives

If you're considering diversifying your P2P investment portfolio or seeking platforms with different features than VIAINVEST, several alternatives might align with your investment goals. Below are some of the top alternatives to VIAINVEST, each offering unique advantages:

1. Debitum

Debitum is one of the best alternatives to VIAINVEST, operating under strict regulatory supervision. It offers investments in asset-backed securities (ABS), providing a similarly structured investment product. Debitum primarily focuses on business loans rather than the consumer loans found on VIAINVEST, giving investors exposure to a different segment of the lending market.

2. PeerBerry

PeerBerry is renowned for its reliability and consistent performance in the P2P lending space. The platform specializes in short-term consumer loans, similar to VIAINVEST, but sets itself apart with a robust group guarantee mechanism. This means that if a loan originator fails, other companies within the group step in to cover the obligations, significantly reducing default risk.

3. TWINO

TWINO is another prominent Latvian P2P lending platform that provides a mix of consumer and business loans across several European countries. Operating under regulatory oversight, TWINO offers added investor protections and a range of investment products, including secured loans.

Conclusion of our VIAINVEST review

VIAINVEST is a robust peer-to-peer (P2P) lending platform that provides opportunities to invest in consumer loans from a diverse range of loan originators. The platform is user-friendly, featuring tools like the VIAINVEST auto-invest function, which simplifies the process by automating your investments.

However, it's important to note that VIAINVEST does not offer a secondary market for its loans. This means that once you commit your funds, they remain invested until the loan term ends, with a minimum duration of 180 days. If you might need quick access to your money, this could pose a challenge due to the lack of liquidity.

The platform offers a return of approximately 11%, which is slightly lower compared to competitors like Swaper and Esketit. During the COVID-19 pandemic, VIA SMS Group, the company behind VIAINVEST, experienced fluctuations in profitability but currently appears to be on stable footing.

Prospective investors should be aware that VIAINVEST has a notable percentage of non-performing loans, making the buyback guarantee an essential feature for safeguarding investments.

In summary, VIAINVEST is a solid option for both novice and seasoned P2P investors, offering a straightforward investment process and a reasonable return, albeit with some liquidity considerations and reliance on the buyback guarantee.