10 Best European Real Estate Crowdfunding Platforms in 2024 🎖️

Want to invest in real estate? Invest with one of the best real estate crowdfunding platforms in Europe:

Avg. return:

~14.70%

Available:

Europe

Launched:

2023

Minimum:

€50

Auto-invest:

No

Sec. market:

No

Protection:

Multiple

Bonus:

+1.5%

Or see our:

Maclear review

Avg. return:

~10.25%

Available:

Worldwide

Launched:

2018

Minimum:

€100

Auto-invest:

Yes

Sec. market:

Yes

Protection:

Mortgage

Bonus:

+1%

Or see our:

Profitus review

Avg. return:

~10.54%

Available:

Most places

Launched:

2014

Minimum:

€50

Auto-invest:

Yes

Sec. market:

Yes

Protection:

Mortgage

Bonus:

+0.5%

Or see our:

EstateGuru review

Avg. return:

~10.29%

Available:

Worldwide

Launched:

2020

Minimum:

€100

Auto-invest:

No

Sec. market:

No

Protection:

Collateral

Bonus:

No

Or see our:

Max Crowdfund review

Avg. return:

~9.98%

Available:

Europe

Launched:

2017

Minimum:

€50

Auto-invest:

No

Sec. market:

No

Protection:

Collateral

Bonus:

No

Or see our:

Brickstarter review

Avg. return:

~9.20%

Available:

Europe

Launched:

2021

Minimum:

€100

Auto-invest:

No

Sec. market:

No

Protection:

Multiple

Bonus:

+0.5%

Or see our:

Tribe Funding review

Avg. return:

~14.20%

Available:

Most places

Launched:

2016

Minimum:

€50

Auto-invest:

Yes

Sec. market:

No

Protection:

Mortgage

Bonus:

No

Or see our:

Bulkestate review

Avg. return:

~14.93%

Available:

Most places

Launched:

2018

Minimum:

€100

Auto-invest:

No

Sec. market:

Yes

Protection:

Mortgage

Bonus:

No

Or see our:

ReInvest24 review

Avg. return:

~9.84%

Available:

Europe

Launched:

2020

Minimum:

€100

Auto-invest:

No

Sec. market:

No

Protection:

Mortgage

Bonus:

No

Or see our:

Letsinvest review

Avg. return:

~6.52%

Available:

Europe

Launched:

2015

Minimum:

€500

Auto-invest:

No

Sec. market:

No

Protection:

Collateral

Bonus:

€10

Or see our:

Rendity review

At P2PPlatforms.com, we strive to list only the absolute best companies in the P2P industry. Where appropriate, we also feature our partners. This doesn’t influence our evaluations. All opinions are our own.

Find the best real estate crowdfunding sites in Europe

If you are looking for the best real estate crowdfunding sites in Europe, you have come to the right place. At the top of this page, you can compare real estate crowdfunding sites, and select the best P2P platform to achieve your investment goals.

Even though there is a lot of great European real estate crowdfunding platforms on the market, you will only find carefully selected companies on the list at the top of this site.

Among the featured companies on this page, you will be able to find real estate P2P lending platforms as well as equity-based crowdfunding platforms.

So if you want to start doing some real estate investing on crowdfunding websites, you have come to the right place to find the best property crowdfunding platforms in Europe.

Selecting a real estate crowdfunding platform in 2024

A few years ago, selecting the best real estate crowdfunding companies to invest with was no issue as there were very few players on the market.

Selecting a real estate crowdfunding platform in 2024 can be somewhat difficult, as there are now in the 10s, if not 100s, of platforms on the market – and many more are launching each year. It’s simply too difficult for beginners to choose between so many participants.

At the top of this page, the field is narrowed down to a smaller list of real estate crowdfunding sites from Europe. See below how you choose between them:

How to select a real estate crowdfunding platform:

- Compare real estate crowdfunding sites with the list at the top of this page

- If needed, read the reviews for more in-depth information about the platform

- Select the platform that matches your investment goals the best

- Start investing in real estate crowdfunding

- Enjoy your returns

When selecting a platform you should look out for whether it’s a private or commercial real estate crowdfunding platform. At the same time, it’s worth considering if it’s a lending-based platform or if it’s a real estate equity crowdfunding platform.

Frequently asked questions:

In the following section, you can find answers to some of the most frequently asked questions about real estate crowdfunding platforms and investing in crowdfunding in general.

What is real estate crowdfunding?

Real estate crowdfunding is used by real estate developers to raise money for projects. They typically do so by allowing a larger number of investors to each contribute a small amount of money to their project. This is typically made possible through big real estate crowdfunding platforms with thousands of investors.

Real estate crowdfunding platforms differ from other P2P platforms by not having a focus on consumer loans, etc.

How does real estate crowdfunding work?

The crowdfunding process is usually ignited by a project owner that wants to get a project funded. They then go to a real estate crowdfunding platform and apply for a loan. If they are able to come up with enough collateral and are deemed as a serious project by the platform, the loan is then usually published for funding on their website.

From here, the investors on the platform will then be able to start reserving a part of the investment. This process can take anywhere from instantly to multiple months depending on the platform.

If the project is fully funded, the project owner will then receive the money funded by the investors. They can then go about completing their project according to their plan.

Investors will be paid back according to a payment plan. When a loan is paid back, the investor can then reinvest into other projects to make them a reality too. As a real estate crowdsourcing investor, you can play a big role in the development of properties around the world.

What is equity-based crowdfunding?

With equity-based real estate crowdfunding, investors have an equity stake in the property. This means that a lot of the investors’ return is dependent upon if the value of the property increases or declines. Most of the return will often come from the property’s rental income.

Investing via equity-based crowdfunding platforms can be compared to investing in and owning a share in a company.

What is lending-based crowdfunding?

With lending-based real estate crowdfunding, investors are practically lending money to real estate developers that are seeking financing for their properties. This means that you are not actually having any ownership of the property.

The investors’ return is dependent on whether or not the real estate developer can pay back the principal and the interest on the loan.

Lending-based real estate crowdfunding can be compared to owning a bond. You can invest in these bond-like loans on crowdlending platforms.

What are the best real estate crowdfunding sites for investors?

The best real estate crowdfunding sites for investors are the ones listed on this website. Most of them have been around for multiple years and have stood the test of time.

Some of the best European real estate crowdfunding platforms include:

- ReInvest24

- EstateGuru

- EvoEstate

- Crowdestate

- Bulkestate

No matter if you are from Europe, Australia, Asia, Africa, Canada, the United States, or the UK, you should be able to invest in properties with one of these European real estate crowdfunding companies.

What are the largest real estate crowdfunding platforms in Europe?

At the time of writing, the 5 largest real estate crowdfunding platforms in Europe, as measured by their total funding, are the following:

- EstateGuru

- BERGFÜRST

- Housers

- CrowdProperty

- Kuflink

The biggest real estate crowdfunding platforms in Europe are not necessarily the best. However, they can be a good indicator of where to start your due diligence.

How do real estate crowdfunding companies make money?

Real estate crowdfunding companies make money from charging fees. As the business model is two-sided, they can earn money by both charging the property developers and the investors a fee on the platform.

The European real estate crowdfunding platforms usually charge the highest fees and make the most money on the real estate developers. Investors on the platforms will only run into very little and sometimes no fees.

Is real estate crowdfunding a good investment?

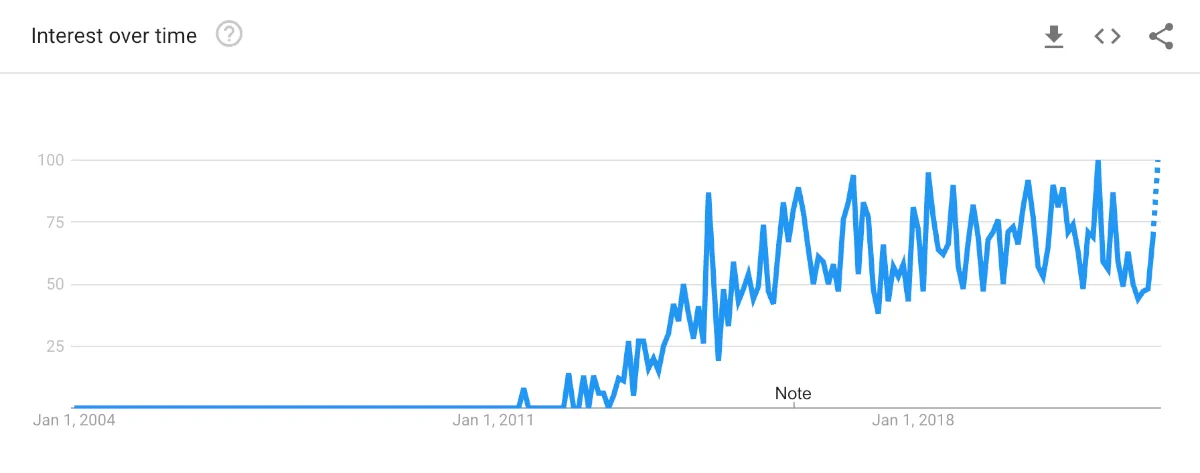

Real estate crowdfunding is a new form of investment that has only been around since the early 2010s. When first introduced, this new investment opportunity sparked a lot of interest among investors.

According to Google Trends, real estate crowdfunding is especially popular in the United States, Canada, Malaysia, the United Kingdom, India, Italy, Vietnam, Argentina, and Brazil.

Before this crowdfunding option became available, investors would have to buy properties directly, through stocks, or by investing in REITs. But this is no longer the case, as real estate crowdfunding platforms have made it easier and more accessible than ever before to invest in property.

If you look at the return some of the top real estate crowdfunding platforms have been able to provide for investors, it has been quite significant and often over 10% annually.

Can you get rich from property crowdfunding?

If you want to get rich from property crowdfunding, you will have to carefully select your platform. This is due to the fact that the return can vary highly depending on which of the many real estate crowdfunding platforms you decide to use, as they have different strategies.

The platforms have different approaches towards risk, market, and many other factors. Some of the main factors that contribute to the return are:

- The loan-to-value of a project

- The geographical area the project is located in

- What type of project you are funding

- The overall risk of the project

A lot of European real estate crowdfunding platforms have consistently provided returns of around 15% and are typically also available for foreign investors.

Oftentimes, these returns are really stable compared to stock investing as the project owners are paying back according to a payment plan.

And even though there sometimes are defaults on platforms, the return doesn’t usually diminish due to the fact that real estate crowdsourcing most of the time includes a mortgage as collateral.

At the end of the day, whether or not you can get rich from real estate crowdfunding also depends on how the market evolves over time.

How do I start crowdfunding in real estate?

If you want to start crowdfunding in real estate, you will have to use one of the many dedicated property platforms on the market.

You will be able to find a small list of only the very best European crowdfunding platforms for real estate at the top of this page.